In Builder Information Systems, checks may be generated manually in a one-off manner, as Cash Disbursements Regular checks, Vendor Checks, AP Checks, Payroll Checks and as Customer Refunds. Checks may also be generated in mass check runs for AP Payable Checks and Payroll Checks using Select for Payment/Print AP Checks and Payroll Hours and Adjusts/Print Payroll Checks. (See: Select for Payment/Print AP Checks and Payroll Hours and Adjusts/Print Payroll Checks articles.)

So, what is the difference between a regular check, vendor check and payable check?

Regular Checks

Regular checks are for payees who are not vendors entered in BIS and for whom invoices have not been, nor will be, entered into BIS. This situation may occur for single instance payments. When a check must be provided to a payee not in the vendor list, the information should be recorded using Cash Disbursements of the General Ledger menu. This procedure is designed for situations where an invoice was not provided, and the payee will not become a regular vendor. For example, perhaps a one-time charitable payment is needed immediately. Instead of going through the process of entering the vendor information, creating, and selecting invoices, users can print just one check. Alternatively, a manual check could be written from the checkbook for the amount agreed. At a more convenient time, that information could be entered into BIS ® and access Cash Disbursements of the GL Menu. The cash account can be updated for the payment done with the manual check. The above-mentioned procedure makes it possible to update the Cash Account and General Ledger whenever manual check needs to be written

Vendor Check

Vendor checks are for existing vendors for whom an invoice or invoices have not been, nor will be, entered into BIS®. The situation may occur when no invoice is provided by the vendor.

Payable Checks

Payable checks are made to existing vendors for whom invoices have been received and entered into BIS®. When an invoice is received from a vendor, the information is recorded using the Vendor Invoice form to update the accounts payable records. These invoices can then be paid either using the Select for Payment/Print AP Checks process or using the Cash Disbursements Payable Checks form. This procedure is designed for situations where it is not convenient to use Select for Payment.

More information may be found in the BIS® General Ledger Reference Manual and the BIS® Accounts Payable Reference Manual.

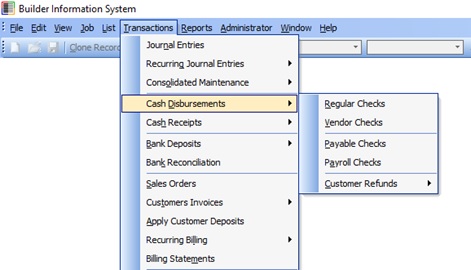

To access any of the Cash Disbursement check forms in the menu:

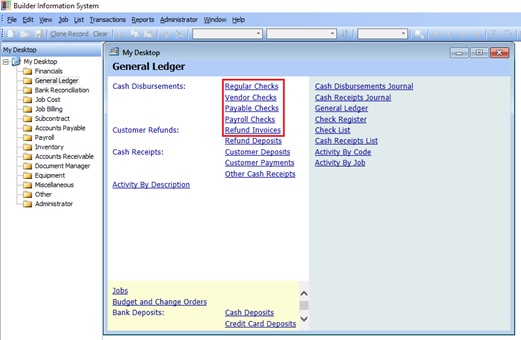

Or by selecting the desired Cash Disbursement check forms link in the white area of the My Desktop, General Ledger form:

More information may be found in the General Ledger manual: