Home Builders’ Setup

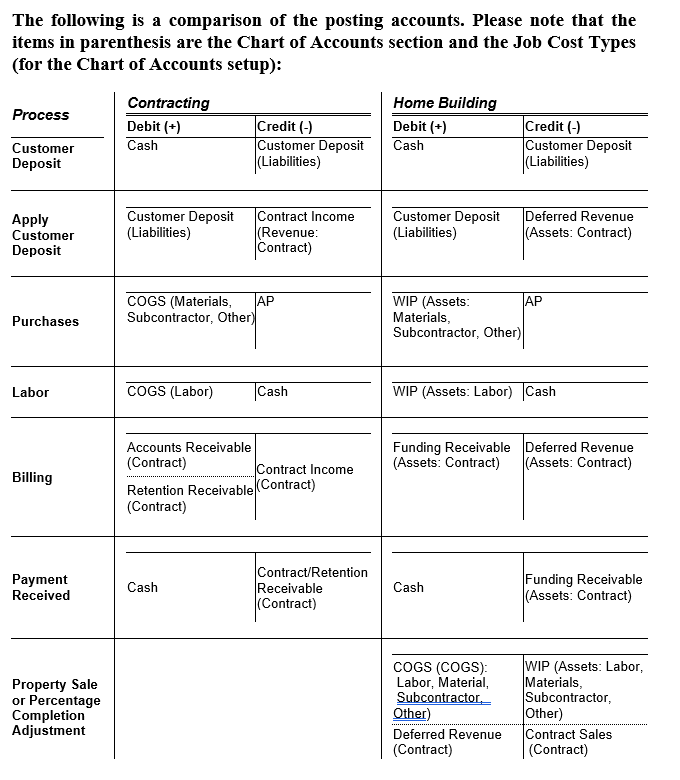

Home builders have different posting requirements than other builders.

With other general contractors, purchases are posted to Cost of Goods Sold and Accounts Payable. With home builders, purchases are posted to Work In Progress (WIP) and Accounts Payable. Similar differences apply to the billing side of jobs. This paper is intended to clarify the posting accounts needed for setup, but it is not authoritative as to every home builder’s accounting requirements.

In BIS®, customer deposits are posted to a Deposit account and Cash, but are not yet linked to a Job. Usually when the contractor begins accumulating costs, the Deposit is applied to the job, and the Deposit is applied to Revenue.

Using the setup described herein, BIS® users can continue to utilize the existing Application for Payment methods, including specifying the percent completion of jobs. Although the AIA® billing format is not applicable as a Request for Funds from a Bank, there are several options:

- After processing the Application for Payment, the user can reprint the “Invoice” as a standard Contract Invoice.

- Using the Form Editor or Report Writer module, changes can be made to the AIA® forms, particularly the cover page, to permit a format more appropriate for banks.

- Using the Form Editor or Report Writer module, changes can be made to the Contract Invoice format to convert it to a format more appropriate for banks.

Closing Out the Sale

Here’s the 8 (or 10 if labor costs apply) line item journal entry suggestion for handling the WIP to COGS process for the moment:

Preliminary: If any changes were made to WIP or COGS GL accounts,

- Reset the WIP accounts and COGS accounts as Job Cost in the Chart of Accounts with their proper Job Cost Type each.

Setup:

- Create a Cost Code WIP2COGS (or what ever Id that wouldn’t appear in the middle of reports), and use the Description: “WIP to COGS Transfer.”

- Create a Vendor with a code zzzzzzzzzz (10 lower case z’s).

Process (except for Subcontract):

- Prior to closing the job (transferring WIP to COGS, etc.), print the GL by Job for the job for each of the cost types (Material, Subcontractor, Other, Equipment [and Labor if used]).

- Create a journal entry line Credit in the WIP GL account for the total of each cost type (except Subcontractor – at this point) in which the TOTAL for the Job and Cost Code Type M, O, or E is entered. Use the new Cost Code 999999 (or whatever was created above for the cost code).

- Create a journal entry line Debit in the COGS GL account for the total of each cost type (except Subcontractor – at this point) in which the TOTAL for the Job and Cost Code Type M, O, or E is entered. Use the new Cost Code 999999 (or whatever was created above for the cost code).

Process for Subcontract:

- Create a journal entry line Credit in the WIP GL account for the total of the Subcontractor cost type in which the total of the Subcontract amount for the job is entered. Use the new Cost Code WIP2COGS (or 999999), and use as the vendor zzzzzzzzzz.

- Create a journal entry line Debit in the COGS GL account for the total of the Subcontractor cost type in which the total of the Subcontract amount for the job is entered. Use the new Cost Code WIP2COGS (or 999999), and use as the vendor zzzzzzzzzz.

Result:

- The WIP GL accounts by Job for that job will show zero.

- The COGS GL accounts by Job for that job will show the correct numbers.