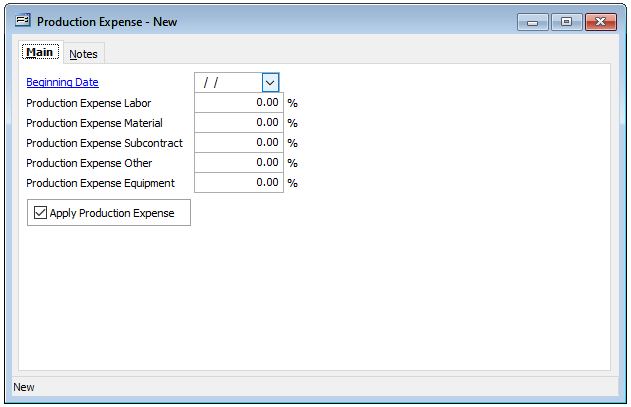

Non-direct payroll burden factors can be entered through the Production Expense.

Job Burden is an important factor that allows contractors to more accurately track and control their jobs. In BIS, Job Burden elements can be tracked in five different areas, of which four are associated with Payroll.

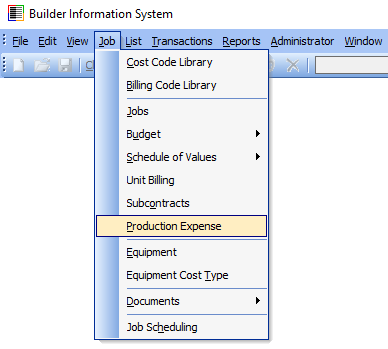

Figure 1. Production Expense is accessed via Job, Production Expense.

Figure 2. The Production Expense form allows the user to enter a production expense factor of each of the categories of costs associated with a job. Note that the factors can be changed at any given time, applicable on subsequent costs.

Production Expense factors are set company-wide, and are applicable to all jobs.

Other areas of Job Burden arise from payroll direct labor. These factors include Union and Workers’ Comprehensive Insurance expenses, as well as FICA and Medicare taxes.

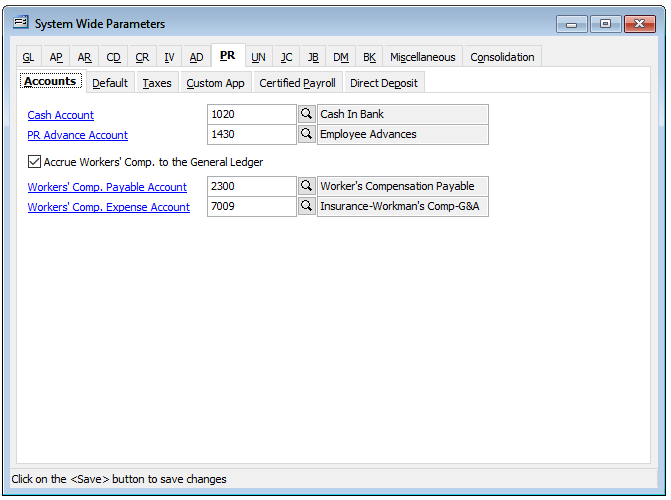

Figure 3a. In Administrator, System Wide Parameters, PR tab, Accounts sub-tab, users can check whether they want to include Workers’ Comp expenses (and payables) to the General Ledger, and thus include them as Burden factors.

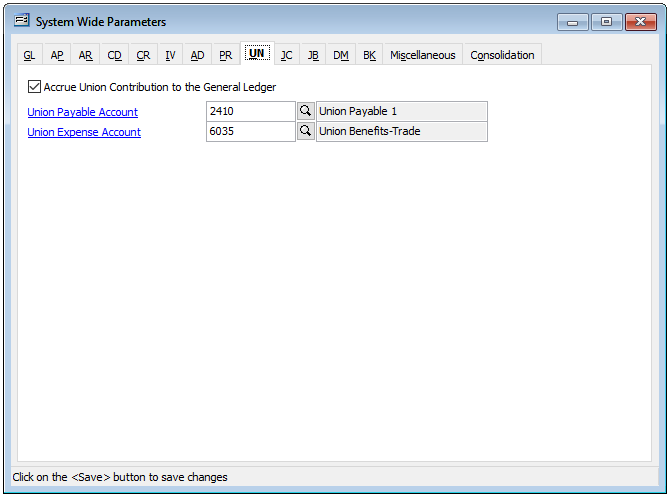

Figure 3b. Also in Administrator, System Wide Parameters, UN tab, Accounts, users can check whether they want to accrue Union Contributions to the General Ledger, and thus include them as Burden factors.

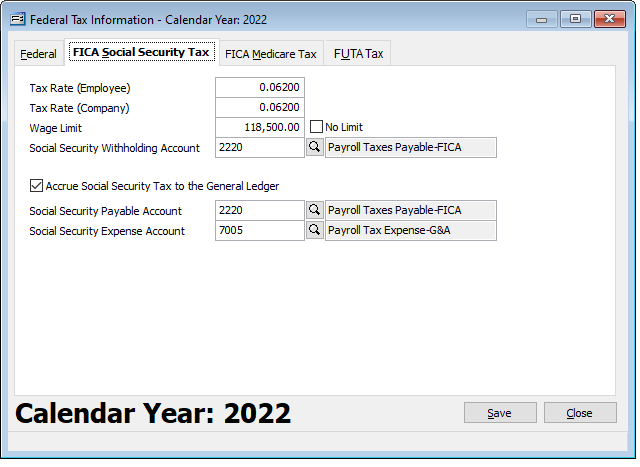

Figure 4. It may also be important to go to the FICA Social Security Tax tab and check the box that allows this tax to accrue to the General Ledger.

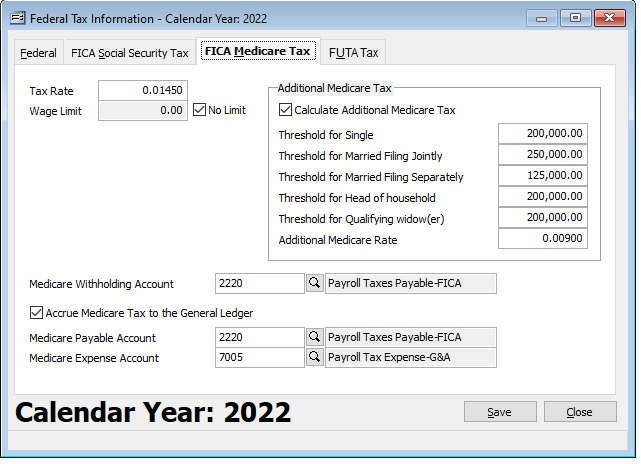

Figure 5. Similarly, it may also be important to go to the FICA Medicare Tax and FUTA Tax tabs and check a similar box that allow these taxes to accrue to the General Ledger.

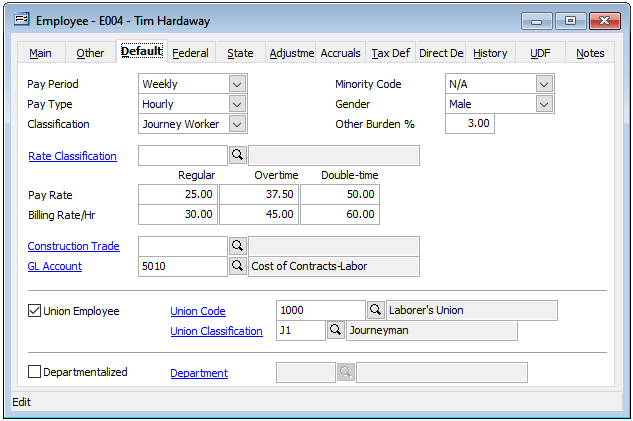

Figure 6. There is one final place in BIS that Burden can be set and applied. Users will probably want to enter an “Other Burden %” rate in applicable employees’ Master Records.

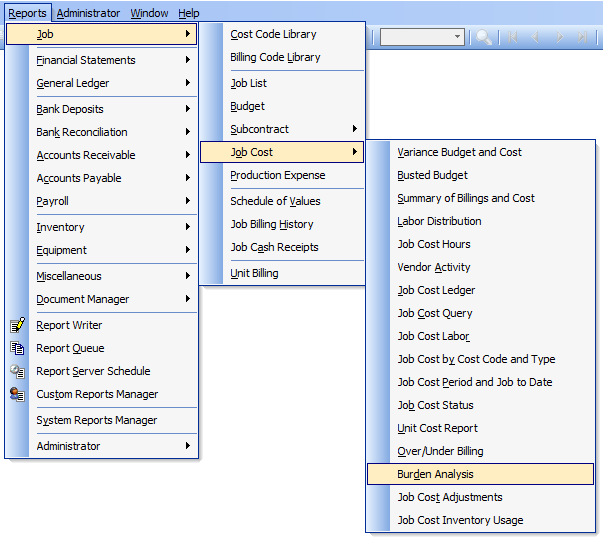

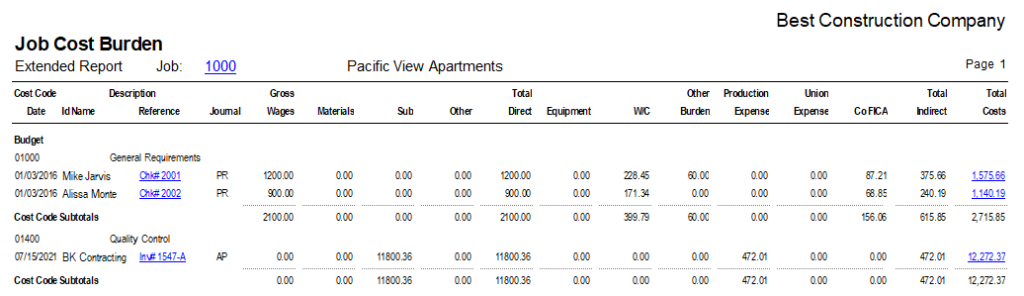

Figures 7 & 8. Finally, Job Burden collected and posted information can be viewed most easily by going to Reports, Job, Job Cost, and then select the Burden Analysis Report.