With the advent of various special state programs like family medical leave, etc., we have developed a universal template functionality that allows users to set up state related programs on-the-fly, as needed.

At this time, this functionality is only accessible for the state of Washington so users may create and implement a special deduction for the new WA Cares Fund.

Note: You may want to create a specific payable and expense account for the WA Cares Fund in your Chart of Accounts before starting this process.

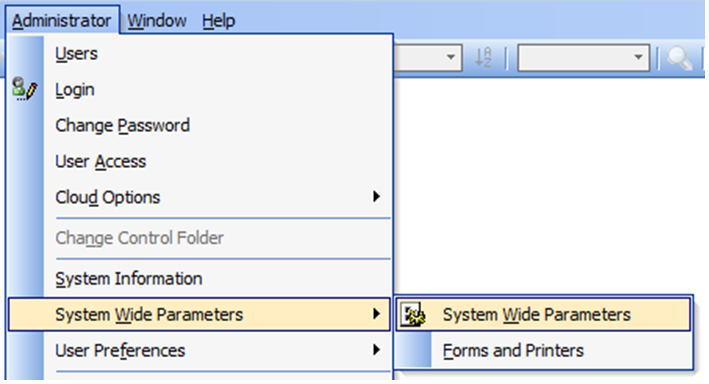

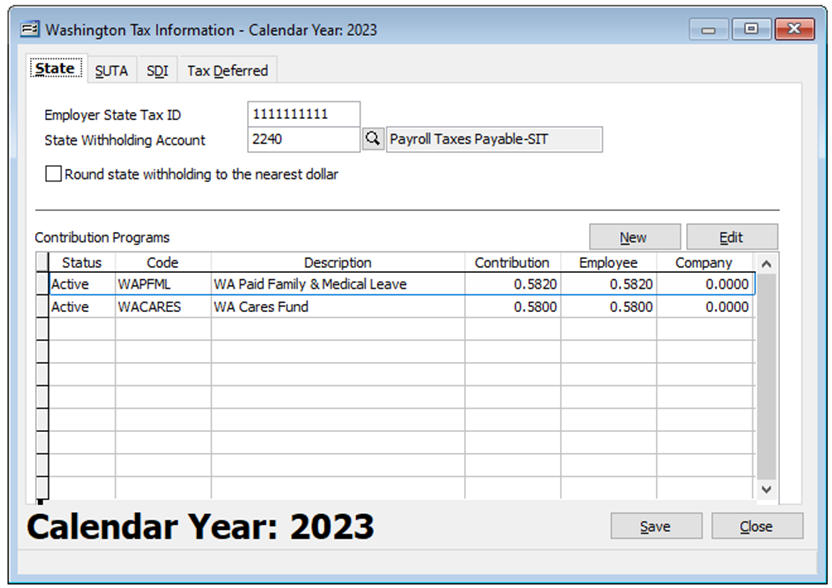

To access, go to Administrator, System Wide Parameters, System Wide Parameters in the Menu. Select the PR tab, Taxes sub-tab, and click the State Tax Information button. Click the Tax ellipses button for Washington.

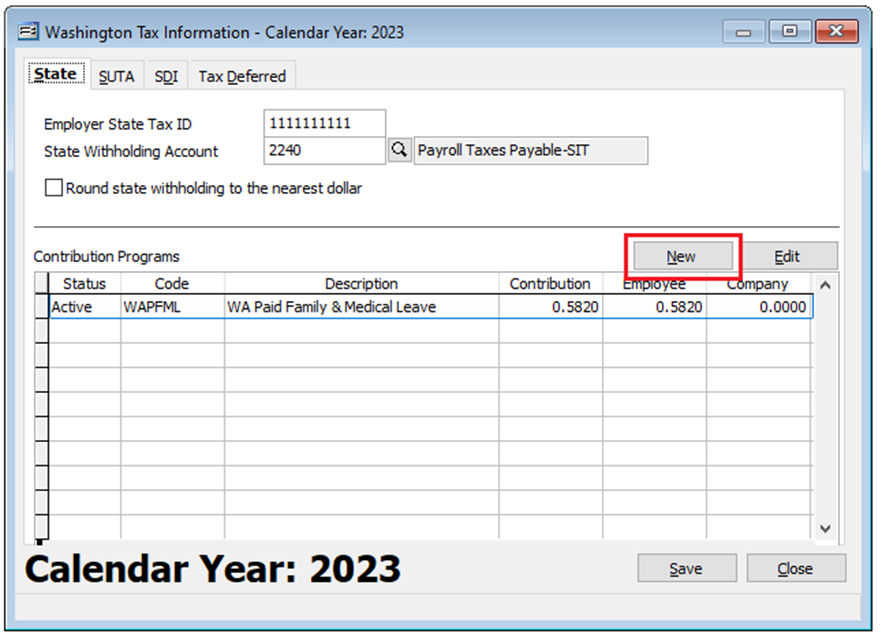

On the State tab, click the “New” button will launch a new Contribution Program form for creating a new program.

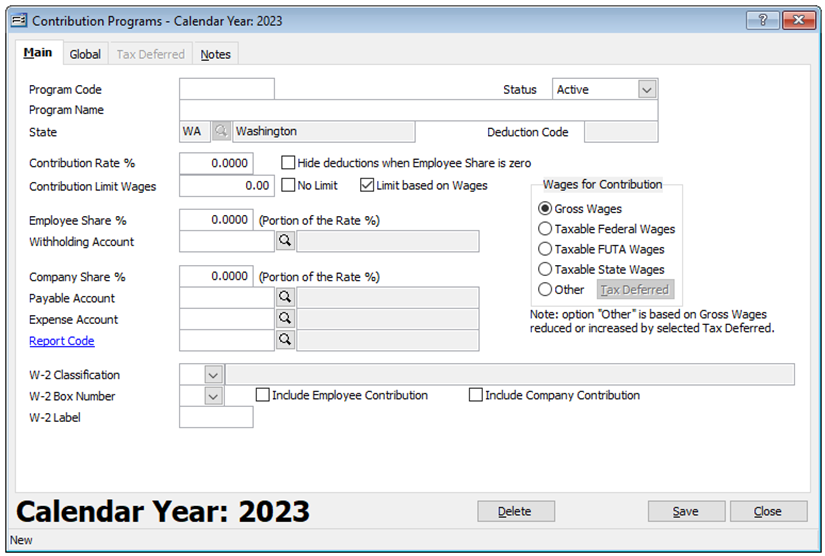

On the Main tab, provide a Program Code and Program Name and proceed with entering the program settings, as needed. Once the Main tab is filled out, click on the Global tab to review which employees the program will apply to. The “Include All” (by default) and “Exclude All” settings are in the lower left and individual employees may be excluded as needed by checking the Exclude checkbox. Once completed, click Save and Close to leave the form.

Note that a program’s settings and Global settings may be changed at any time by revisiting the form, making the needed changes, and clicking “Save” on the form.

To reopen, double-click the desired line on the form:

Once completed, save the System Wide Parameter settings.

Information to keep in mind:

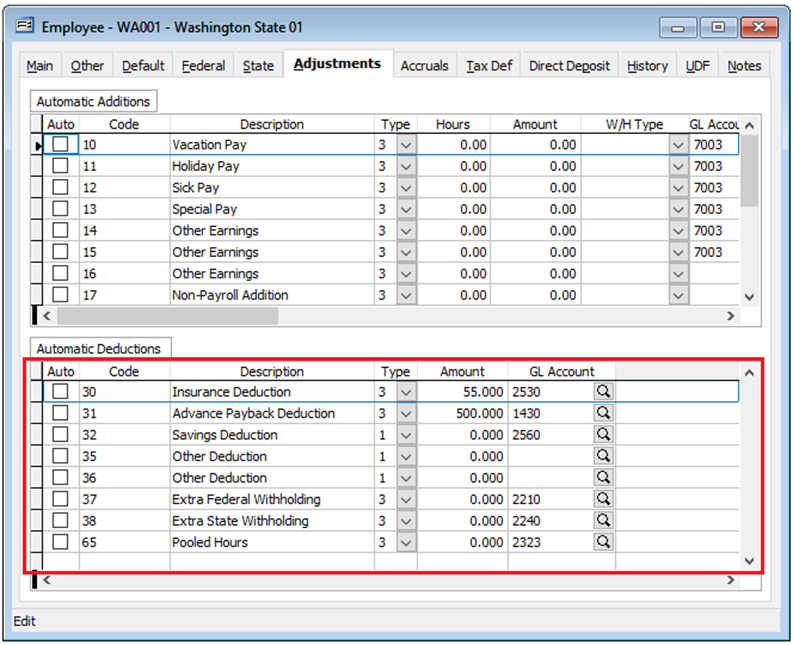

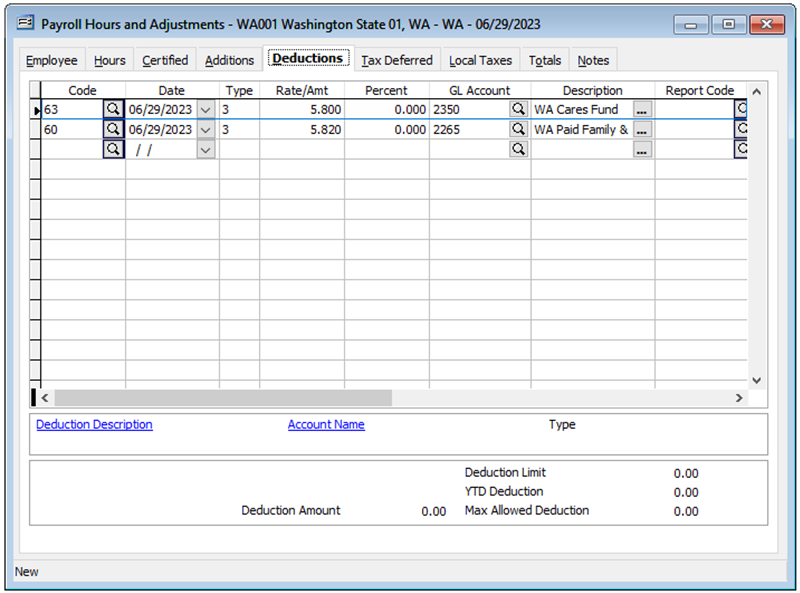

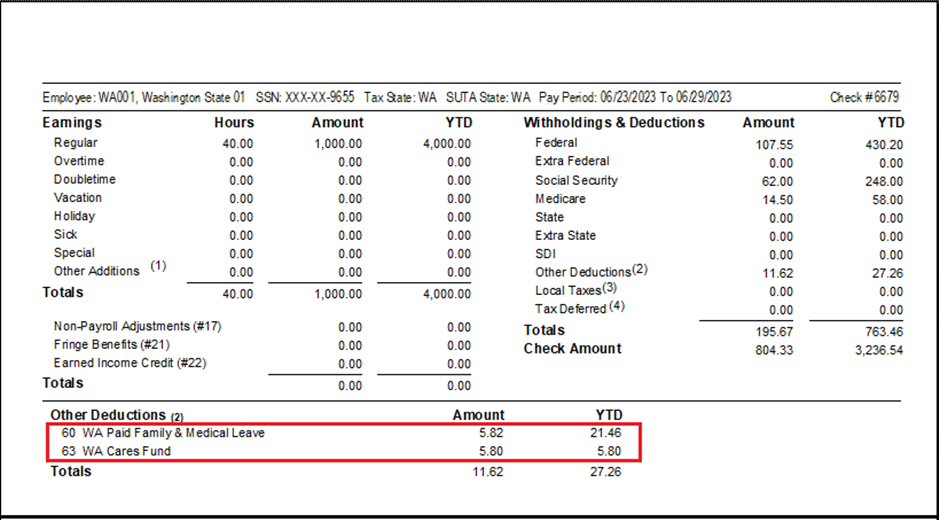

An internal deduction code is created for the Contribution program which WILL NOT appear in the Employees master record. The deduction will automatically appear in Payroll Hours & Adjustments on the Deductions tab and the Totals tab and in all related areas and reports associated with the payroll process including the Payroll Prepayment List and payroll paystubs.

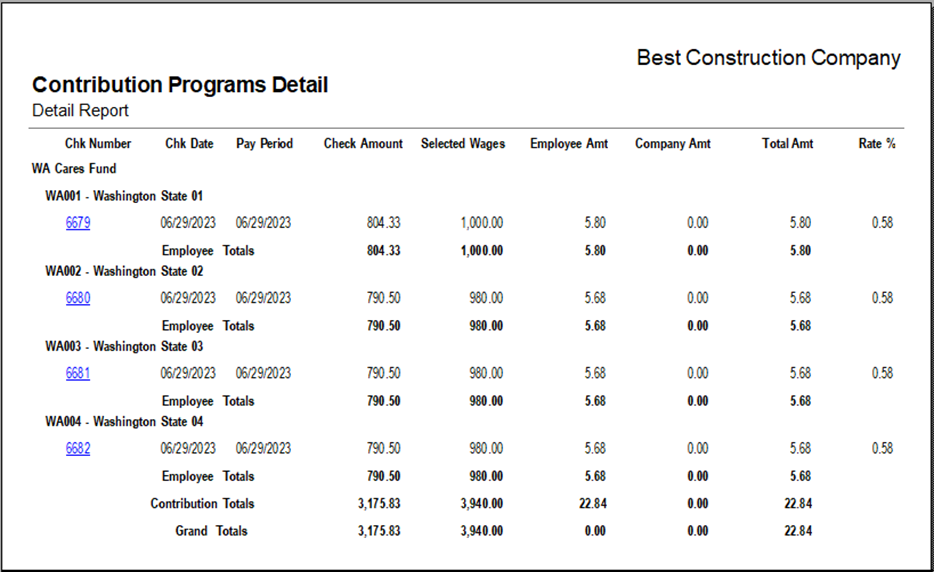

Contribution Programs Report

A Contribution Programs Report query has been added to Payroll reports menu to provide Contribution Programs specific information.

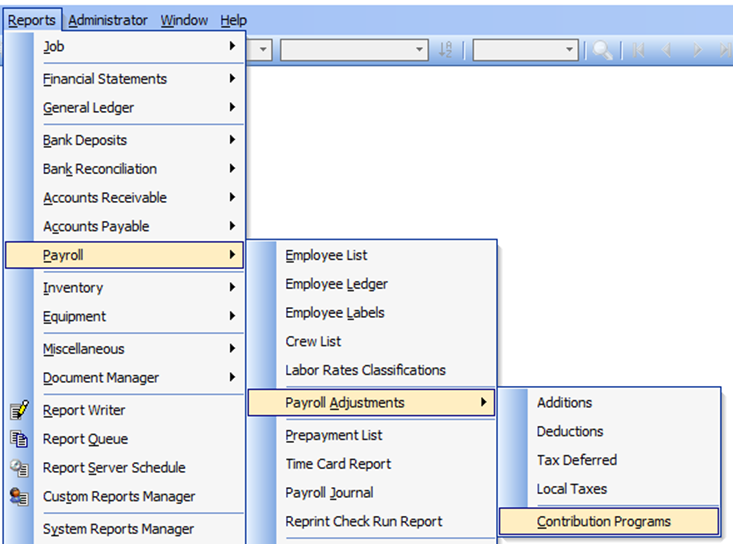

To access, go to Reports, Payroll, Payroll Adjustments and select Contribution Programs in the menu or select the link in the blue area of the My Desktop Payroll module.

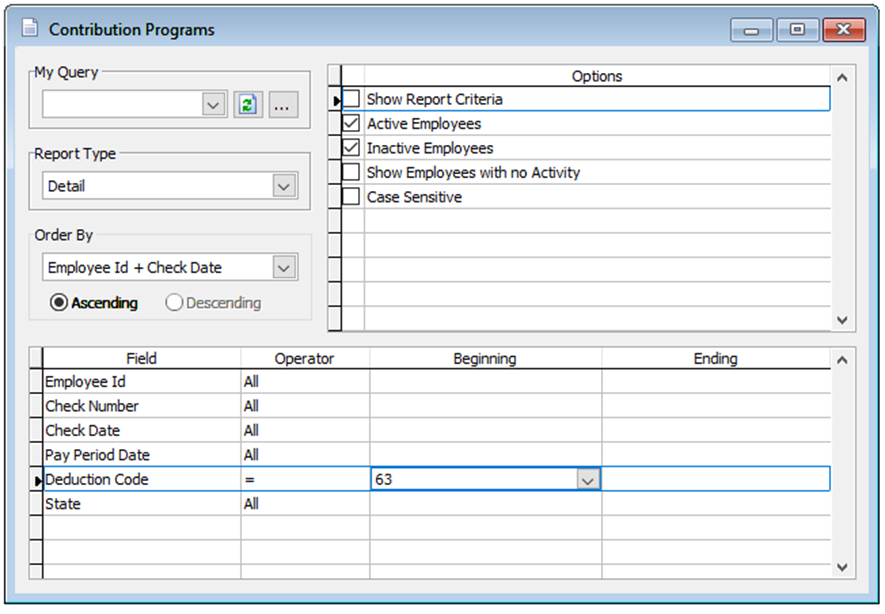

Enter or select a desired Contribution Program’s Deduction Code and print or preview.

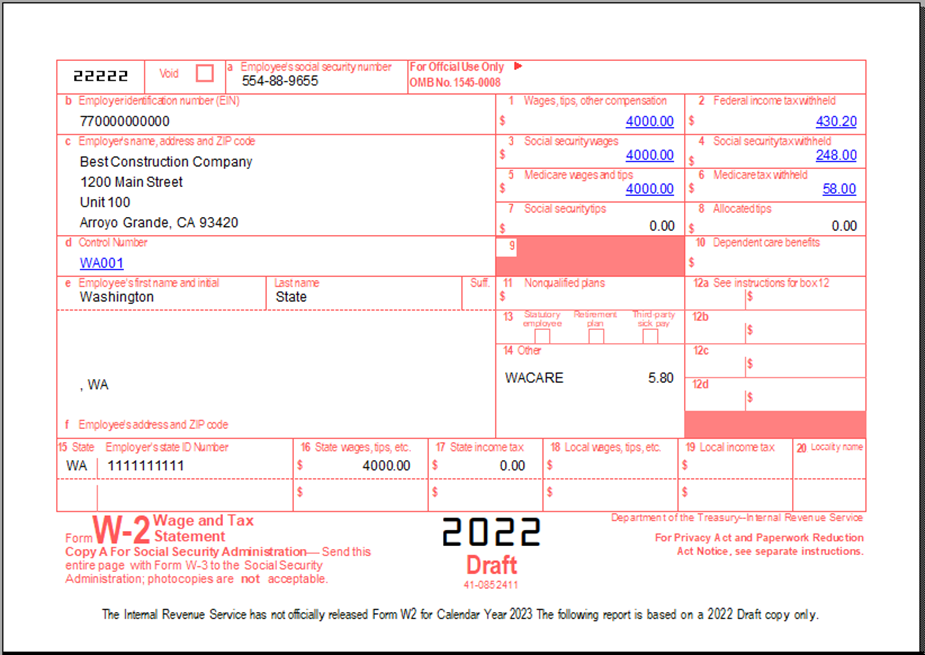

The Contribution Program form also provides an option to have the information appear on the W-2 forms, if needed.