The company contributions for payroll expenses can be accrued to the general ledger at the time payroll is processed before the expense is actually paid. This option will produce an automatic journal entry for each paycheck run to post the accrued contribution to both a payable account and an expense account. If you choose not to accrue contributions, these amounts will be reflected on the general ledger until they are paid. The amounts can be viewed in the appropriate report relating to the type of contribution.

Contributions may be set as accrued for the following areas in BIS:

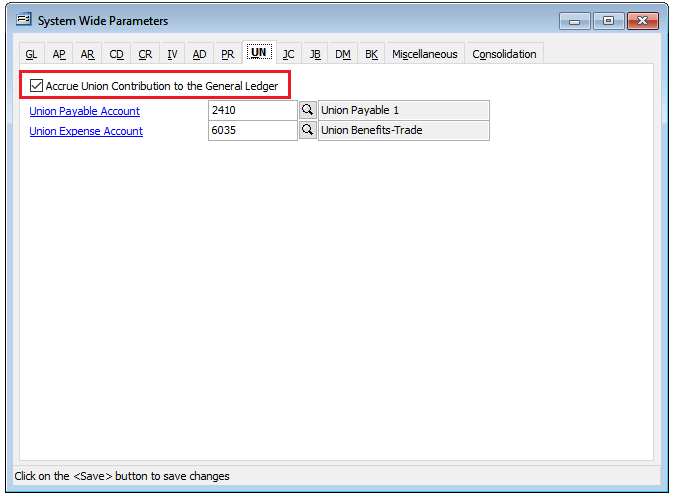

Union – the UN tab in System Wide Parameters.

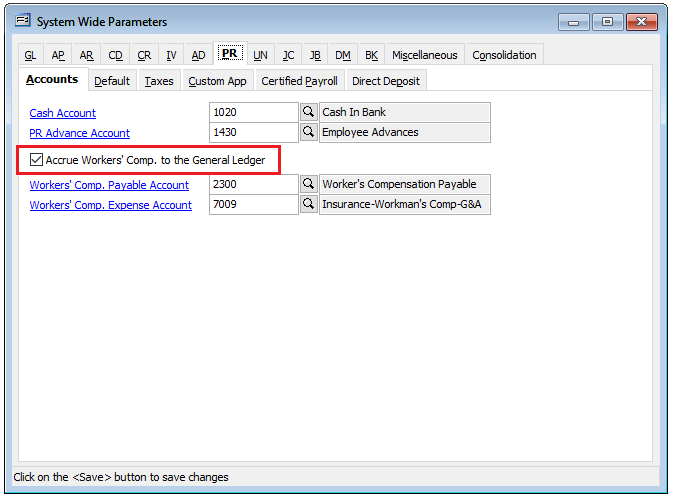

Workers’ Compensation – the PR tab in System Wide Parameters.

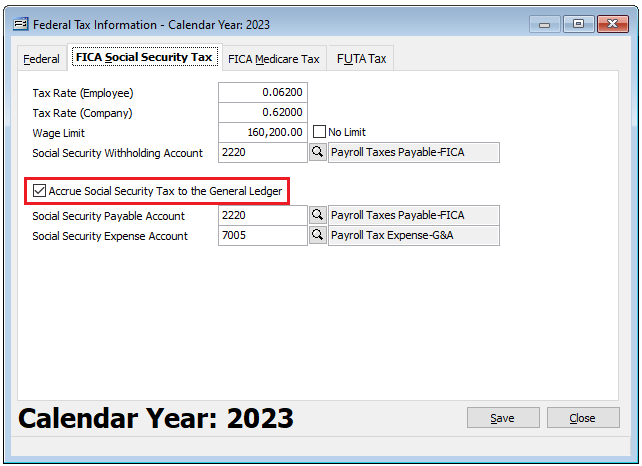

Social Security – the FICA Social Security tab on the Federal Tax Information form in System Wide Parameters.

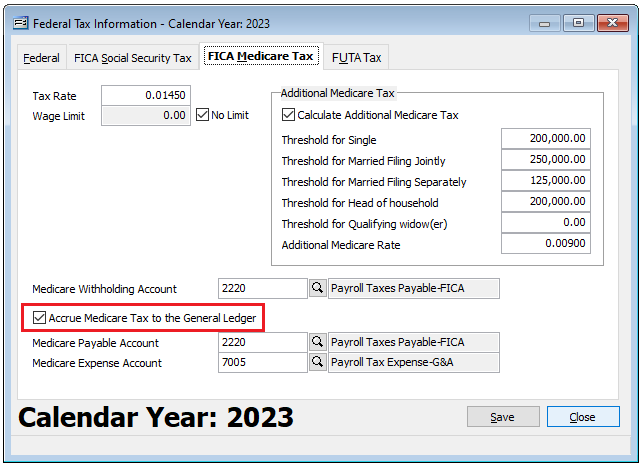

Medicare – the FICA Medicare Tax tab of the Federal Tax Information form in System Wide Parameters.

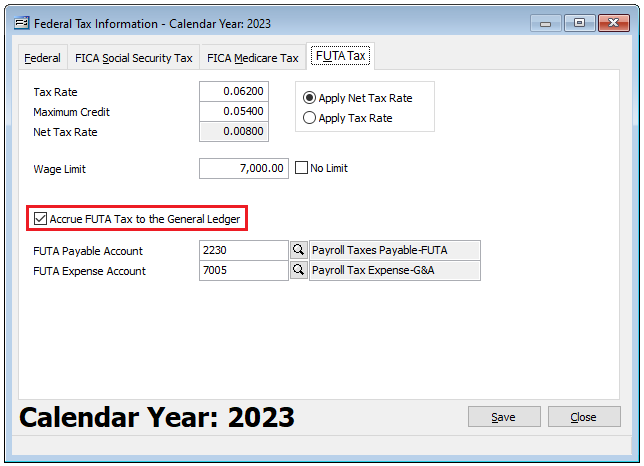

FUTA – the FUTA Tax tab of the Federal Tax Information form in System Wide Parameters.

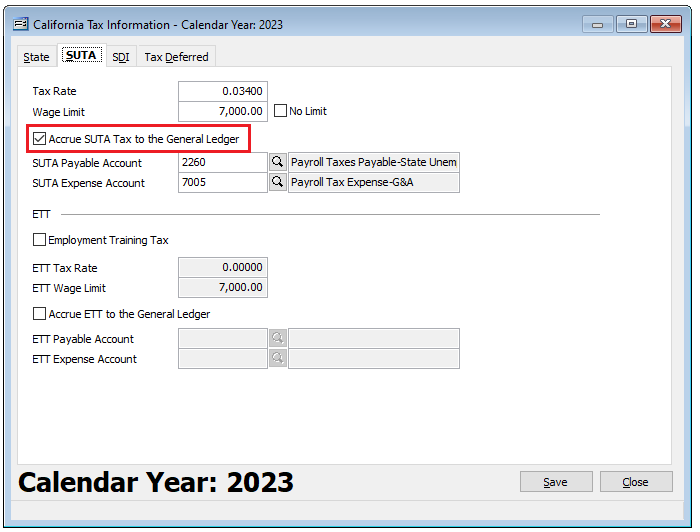

SUTA – the SUTA tab of the State Tax Information form for the state selected in System Wide Parameters.

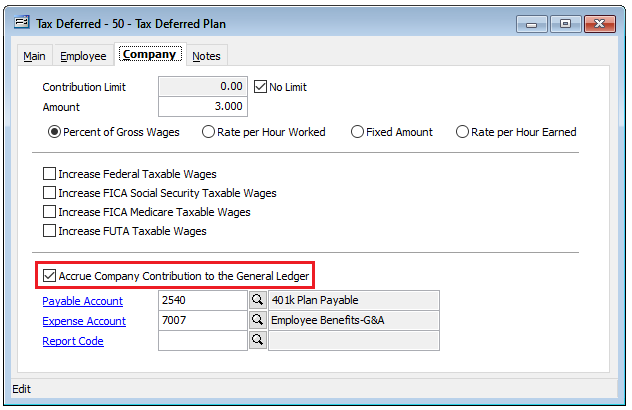

Tax Deferred Programs – the Company tab of Tax Deferred form found in List, Payroll Adjustments in the menu.

To begin accruing company contributions to the general ledger:

- Go to the appropriate form and tab for the type of contribution listed above.

- Check the option to accrue that type of contribution.

- Enter a default payable account and expense account.

- Save the changes on each form.