Beginning Balances will be entered into BIS in the following sequence:

- General Ledger

- Accounts Payable

- Payroll

- Job Billing/Accounts Receivable

In this description, several terms are used rather interchangeably. Accounts Receivable can mean that, or it can mean Contracts Receivable. Revenue or Contracts Revenue can also be listed as Sales. Retainage and Retention are used interchangeably.

General Ledger

General Ledger Beginning Balances will be entered as Journal Entries based on the balances obtained from the previous accounting system.

There will be several exceptions of posting accounts, however. The user should have previously, or will need to now, setup Accounts Payable Suspense, Accounts Receivable (or Contract Receivable) Suspense, and a Payroll Suspense account. Optionally, the user can also setup a Retainage (or Retention) Suspense Receivable account. These suspense accounts can be numbered adjacent to their regular counterparts in the Chart of Accounts, or grouped together, preferably in the Assets or Liabilities section of the Chart of Accounts. It is important that the new Accounts Receivable Suspense (or Contracts Receivable Suspense and/or Retainage Receivable Suspense) accounts all set as Contract under the Job Cost type in List/Chart of Accounts.

Once these accounts are added to the Chart of Accounts, the Beginning Balances from the old system can be entered into the BIS General Ledger as Transaction/Journal Entries. There will be two (or three) exceptions to the posting accounts from the old system: Rather than post Accounts Payable to the Accounts Payable account, it will be posted to the Accounts Payable Suspense Account. Rather than post Accounts (or Contracts) Receivable to the Accounts (or Contracts) Receivable account, it will be posted to the Accounts (or Contracts) Receivable Suspense Account. Finally, rather than post Suspense Receivable to the Suspense Receivable account, it will be posted to the Suspense Receivable Suspense Account.

At the end of the process, the General Ledger must be balanced. The General Ledger can be verified by printing the Trial Balance from Reports/Financial Statements/Trial Balance. If not, the error must be located and corrected.

Accounts Payable

Each unpaid, or unpaid portion of each, invoice must be entered into the Accounts Payable Transactions/Vendor Invoices. It is crucial to note that if an invoice has been partially paid, only the amount not yet paid will be entered.

Unlike the normal entry of invoices, however, the expenses all of these invoices will be posted to the Accounts Payable Suspense Account (shown as the GL Account on the screen form). The Accounts Payable Account will remain unchanged, however.

The process will be correct and complete when the Accounts Payable Suspense account is zero, meaning that the total of all unpaid invoices matches the amount transferred from the prior accounting system. If the suspense account does not reach zero, the error must be located and corrected.

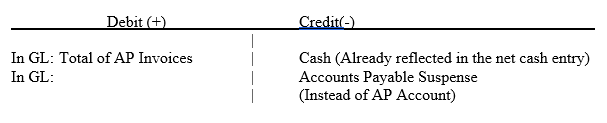

Thus, in General Ledger (as it applies to Accounts Payable), entries from the old system:

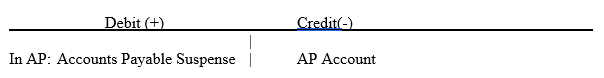

When entering the open portion of each invoice in the Accounts Payable module, the entries will be ultimately be posted to General Ledger as follows:

Thus, if the entries in the new Accounts Payable module match the value already entered in the AP Suspense account of General Ledger, entering all of the unpaid invoices in this manner will zero the AP Suspense Account.

After successfully completing this step, all subsequent AP Invoices should use the normal accounts and NOT the Accounts Payable Suspense Account.

Payroll

The simplest way to enter previous payroll, and still get important payroll reports, is to enter one Payroll Check for each employee for each quarter, or portion of a quarter, in the current calendar year. (As is noted below, these payroll “checks” will affect only the Payroll Suspense account in General Ledger.) These entries can be done from Transactions/Cash Disbursements/Payroll Checks. Each “check” should be dated with the last day of the applicable quarter (or month). Each account in the Payroll Accounts (second) tab must be set to the Payroll Suspense account.

When entering hours, the user can either enters the total hours worked and the actual hourly rate or records one hour on the hours line, and set the payroll rate for that line to the total for that quarter. Again, it is very important that the GL account on the hours line is changed to the Payroll Suspense account.

In addition, the quarter-to-date additions, deductions, and tax deferred items are recorded, also using the Payroll Suspense account for posting.

Using the Totals tab, the user should record the quarter-to-date taxes, based on information from the prior accounting system records.

This process will be duplicated for each quarter of the employee’s tenure in the current incomplete calendar year of the current fiscal year. The process must be completed accurately for each employee.

An alternative method is to enter each check of the calendar year, using the same method as described above, if check-by-check detail is needed, or if the fiscal year changed only shortly before initializing BIS Accounting Software.

From this point forward, all subsequent Payroll processing should use the normal accounts and NOT the Payroll Suspense Account.

Jobs in Progress

For each job being tracked from the old system, a Budget and Schedule of Values must be entered. However, a Schedule of Values is only necessary if the particular job had lump sum or cost plus styles of billing in the prior accounting system.

Both the Budget and Schedule of Values should be created manually for each job’s initial setup via the Job Menu. It is important to note that the entries will be for the entire job, and not just the portion of the job still incomplete.

Next, Job Cost Adjustments (done via Transactions/Job Adjustments) will be entered for each job. Lump entries can be made for each cost code cost type (or, for greater detail, an entry can be created for each item in the old system).

Accounts Receivable/Billing

Simple Contract Invoice

If the prior billing was a simple Contract Invoice for the job, a similar transaction can be done in BIS via Transactions/Customer Invoices/Contract Invoices. The total should be the same as what had been billed for the job so far, and should be coded to the Accounts Receivable Suspense, Contracts Receivable Suspense, and/or Retainage Receivable Suspense account(s) already created.

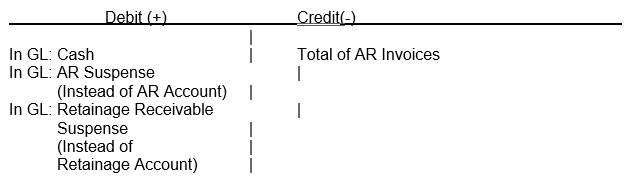

Thus, in General Ledger (as it applies to Accounts Receivable), entries from the old system:

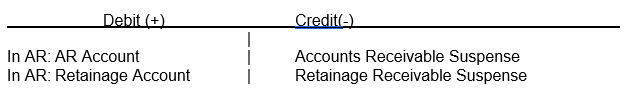

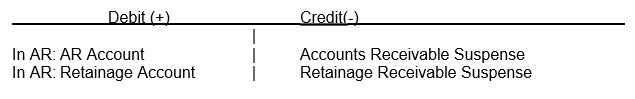

When entering the open portion of each invoice in the Accounts Receivable module, the entries will be ultimately be posted as follows:

The payments to date for those invoices are posted as follows:

If the entries in the new Accounts Receivable module match the value already entered in the AR Suspense and/or Retainage Suspense accounts of General Ledger, entering all of the unpaid invoices in this manner will zero them both.

Progress or AIA Billing

If prior billing was based on progress (or AIA billing), the Schedule of Values will need to be adjusted.

A progress or AIA billing from a lump sum or cost plus method requires that each line in the Schedule of Values be updated to the state prior to the last billing in the prior accounting system. This process is done via Job/Schedule of Values/Schedule of Values. An Application for Payment is the created from the Transactions/Customer Invoices/Application for Payment. Under the AR Account tab, the Contract Revenue (or Sales) account must be reset for the Accounts Receivable/Contracts Receivable Suspense account.

Finally, Job Receipts prior to current billing must be entered via Transactions/Cash Receipts/Customer Payments. It is vital that all accounts under the CR (Contracts Receivable) tab are set to the suspense account for this billing. However, the Accounts Receivable account setting is left untouched.

After posting the initial billing history, the last billing from the former accounting system will need to be entered for each job. The Schedule of Values will need to be updated a second time (to reflect these latest numbers), and another Application for Payment will need to be completed. For this Application for Payment, only the income account on the CR Account tab should be set to the suspense account.

At this point, all current jobs should now accurately reflect the current billing. The process will be correct and complete when the Accounts Receivable Suspense account is zero, meaning that the total of all unpaid invoices matches the amount transferred from the prior accounting system. If the suspense account does not reach zero, the error must be located and corrected.

From this point forward, all subsequent Billings and Cash Receipts should use the normal accounts and NOT the Accounts Receivable, Contracts Receivable, or Retainage Suspense Accounts.