Startup businesses and others may want to bill the labor performed by the owners even though they may not receive a paycheck. Provided that Cost Plus Billing and a Manually Entered Billing Rate are used, there are two easy ways to process such information in BIS.

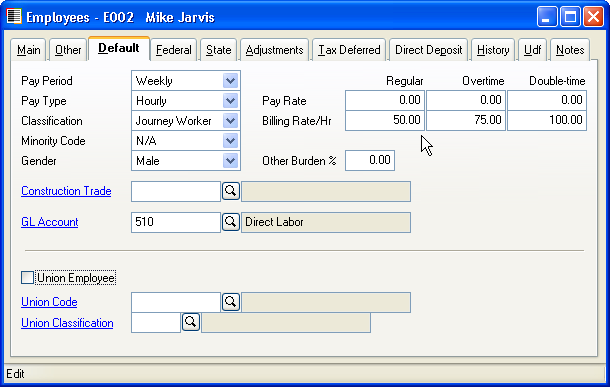

In either case, the first step is to set the owner/employee Master Record with the correct information.

Figure 1-1. Set the employee with a zero pay rate. It doesn’t matter whether the owner/employee is set as an hourly or salary employee. Enter the Billing Rate/Hour for the owner/employee.

2. Job Adjustments Method

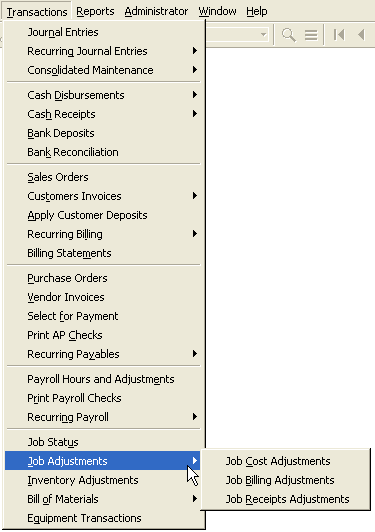

In this method, the second step is to make entries to the Job Adjustments screen.

Figure 2-1. From the Transactions menu, select Job Adjustments, and then Job Cost Adjustments.

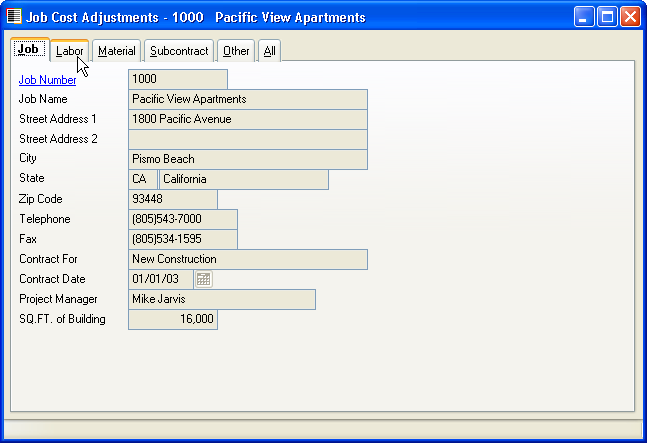

Figure 2-2. Select the correct Job and then click on the Labor Tab.

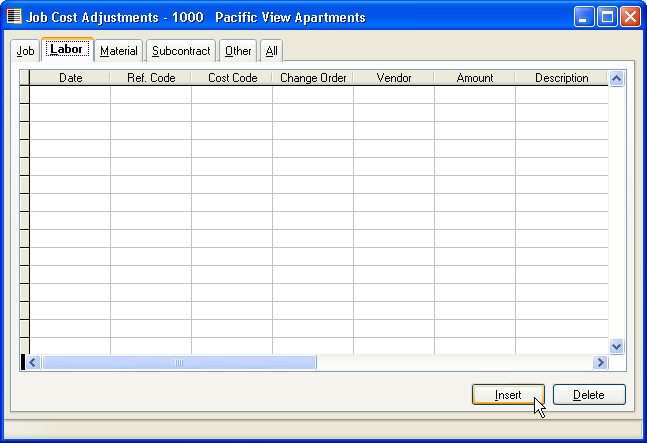

Figure 2-3: Click on the Insert button in the lower right-hand corner of the form.

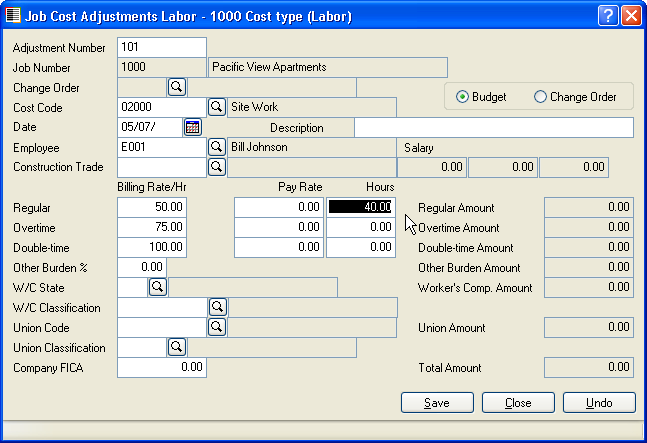

Figure 2-4. Enter an Adjustment Number; select the Cost Code, Date, and Employee. The Billing Rate should already be set (from the Employee Master Record). All that is still needed is to enter the Billable Hours applicable to the job. Then save the data, close the Job Cost Adjustments Labor and the Job Cost Adjustments screen, and return to the main screen.

At this point, the user should follow the steps beginning with Figure 4-1 below.

3. Payroll Check Method

This method employs a relatively normal process of creating a zero balance payroll check for the employee. If the employee is later to be added to payroll, this method may be preferred to ensure a more uniform process.

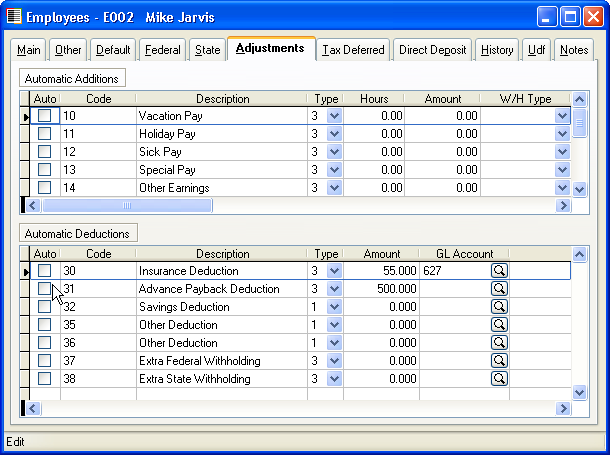

Figure 3-1. Make sure that none of the Automatic Additions or Automatic Deductions is operational for this owner/employee.

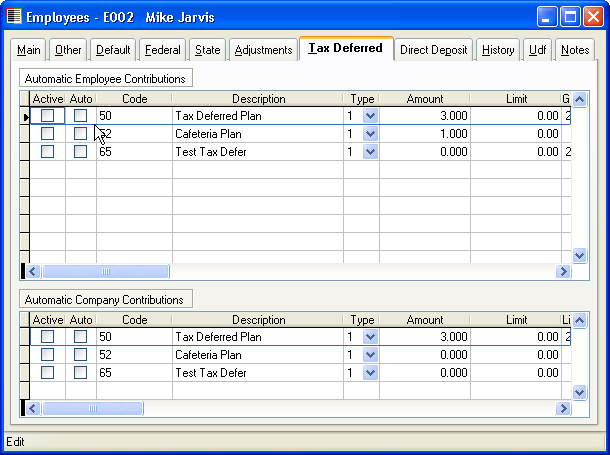

Figure 3-2. Make sure that none of the Tax Deferred Automatic Employee Contributions or Automatic Company Contributions is operational for this owner/employee. Then save the Owner/Employee’s Master Record.

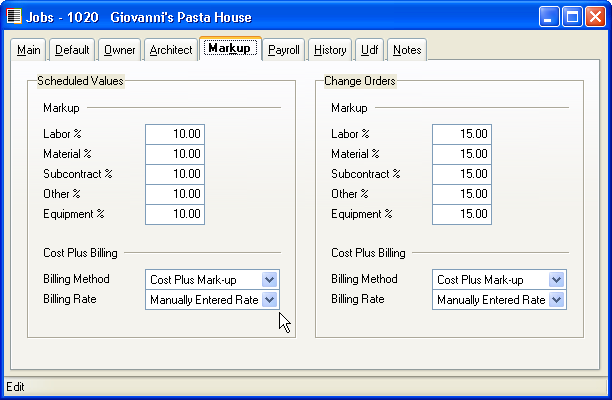

Figure 3-3. Make sure that Job’s Billing Rate is set to Manually Entered Rate for both Scheduled Values and Change Orders, and save the record.

Payroll is processed normally. The appropriate number of hours worked by the Owner/Employee are entered, and distributed to the Job (or Change Order) and Budget Cost Code, just as it would be for any employee.

Billing proceeds normally. See Figure 4-1.

4. Billing Process

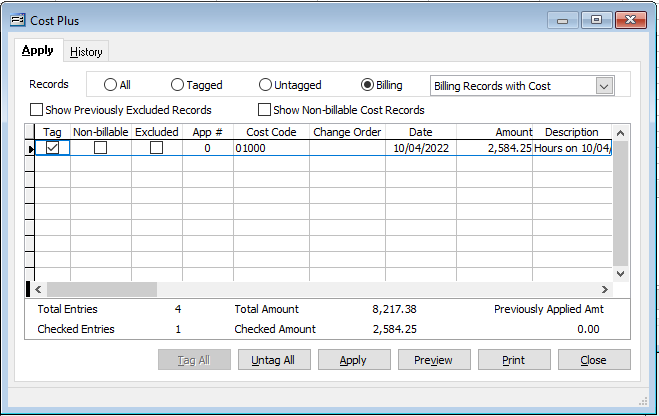

Figure 4-1. Finally, when processing the Schedule of Values for billing, the Work in Place/Cost Plus method of billing must be selected for the Billing Code. The labor amount will appear, but will show a zero amount of cost, reflecting the fact that the employee received no actual payroll check.

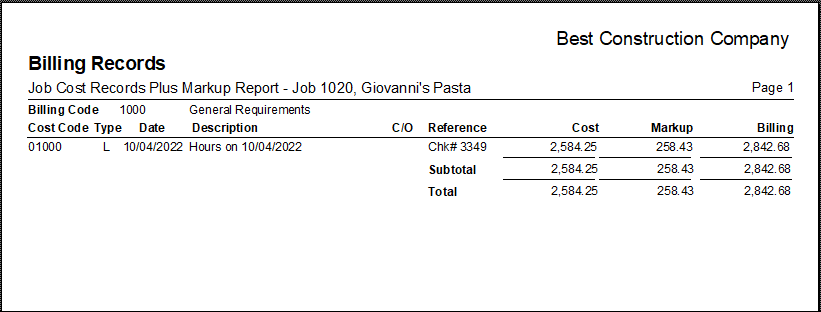

Figure 4-2. If the Job Cost Record with Markup is viewed, it will show the billing amount.

Once the item is selected, it is billable in the normal fashion.