The Cash Receipts Customer Payments option allows payments to be received and applied to outstanding customer invoices. If the payment received is a deposit, the Customer Deposits form should be used to post the receipt. If the payment is not to be applied to outstanding invoices, consider using the Other Cash Receipts option. BIS ensures that all receipts are traceable by providing a clear and accurate audit trail. Each payment entered automatically updates the cash receipts journal, general ledger, and financial statements.

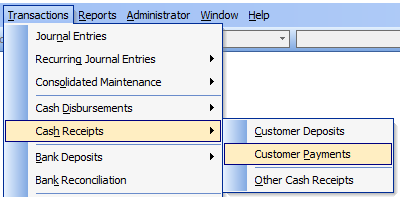

To access, go to Transactions, Cash Receipts and select Customer Payments in the menu or select the Customer Payments in the white area of the My Desktop, General Ledger folder.

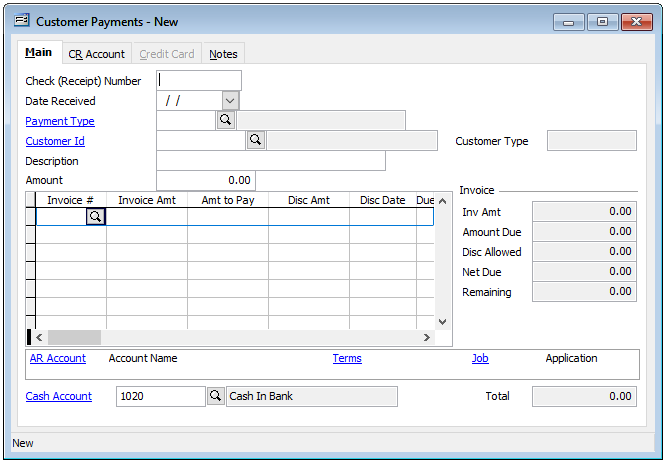

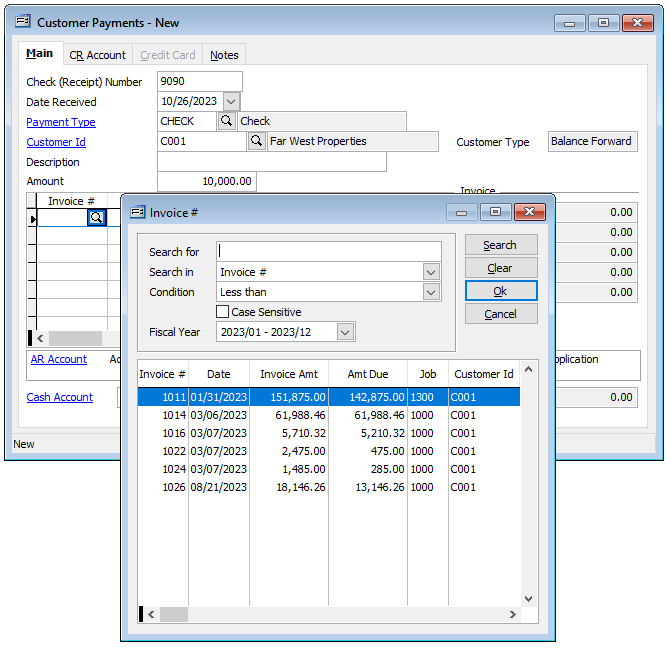

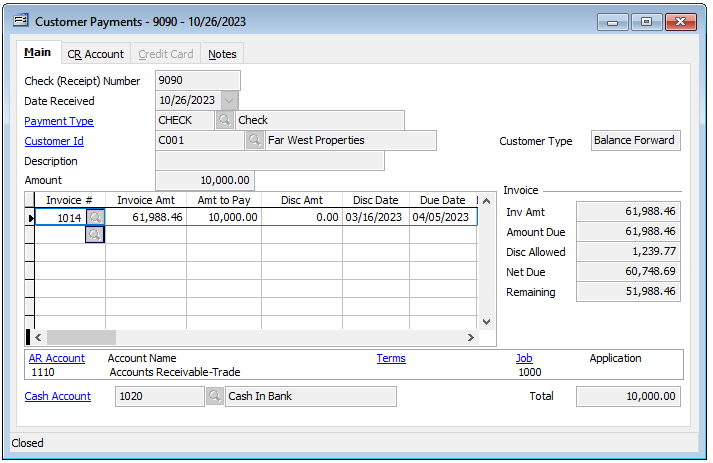

On the Main tab enter the Check (Receipt) Number and Date Received. Select the Payment Type and Customer ID. Optionally, a Description may be entered. Enter the payment amount. Advancing to the first line, clicking on the Invoice # lookup will show all open invoices available to apply payments to. Select or enter the invoice, Invoice Amount will auto-populate, advance to the Amount to Pay field, and enter to amount to be applied to the selected customer invoice. Advance to the next line if additional Customer Invoices are to be paid by the customer payment received.

Note that if a discount is an option, a prompt will appear to clarify whether you wish the discount based on the Customer’s master record and the Discount Date.

Verify that the Amount and Total equal each other to assure a balanced transaction prior to saving the transaction. Click Save or Ctrl+S to post the payment.

On the Main tab enter the Check (Receipt) Number and Date Received. Select the Payment Type and Customer ID. Optionally, a Description may be entered. Enter the payment amount. Advancing to the first line, clicking on the Invoice # lookup will show all open invoices available to apply payments to. Select or enter the invoice, Invoice Amount will auto-populate, advance to the Amount to Pay field, and enter to amount to be applied to the selected customer invoice. Advance to the next line if additional Customer Invoices are to be paid by the customer payment received.

Note that if a discount is an option, a prompt will appear to clarify whether you wish the discount based on the Customer’s master record and the Discount Date.

Verify that the Amount and Total equal each other to assure a balanced transaction prior to saving the transaction. Click Save or Ctrl+S to post the payment.

Field Descriptions:

Check (Receipt) Number

Records the number of the customer check or receipt for this payment. This is an alphanumeric field limited to ten characters.

Date Received

Records the date that the payment was received. The date may be entered manually, in the mm/dd/yy format, or by using the Calendar tool.

Payment Type

Records the payment type code that corresponds to this payment. These codes are maintained in the Payment Type file. The code may be entered manually or by using the Find tool.

Customer ID

Records the customer identification number related to this record. The customer ID may be entered manually or by using the Find tool.

Description

Records a general description for this transaction. This is an alphanumeric field limited to 30 characters.

Amount

Records the total amount of the customer payment. The amount recorded here must balance with the detailed distribution on the table below.

Customer Type

Displays the type established in the Customers master record for this customer.

Payment Distribution Detail

The table records the distribution detail for the payment selected. The Invoice Number column records the number of the customer invoice that is being paid with this payment. The invoice number may be entered manually or by using the Find tool. This will pull up the related invoice information in the Invoice Amount and Discount Amount columns. The Amount to Pay column records the total dollar amount to be applied to this invoice from the current payment. The amount of this payment may be applied to as many invoices as needed. The Description column is used to record a brief description for the transaction line item. Clicking the button in this column allows an extended description to be recorded for the item. The Report Code column is used to record a report code related to the line item, which can be used for creating customized reports. If the invoice selected is related to a specific job, the button in the Job column will open the Job Cost screen, where the item can be posted to a job, change order, and cost code.

Discount Date

Displays the date by which the invoice selected must be paid by the customer in order to receive the discount.

Due Date

Displays the date by which the invoice selected must be paid by the customer before it is considered past due.

Discount Allowed

Displays the amount of the discount allowed if the invoice is paid by the customer before the discount date.

Amount Due

Displays the total amount due for the invoice selected, less any discounts allowed.

Remaining

Displays the amount remaining for the invoice selected, which is the amount due less any payments made.

Posting and Invoice Summary

This section displays a summary of information related to the posting of this invoice. The accounts receivable account number and name to which this payment will be posted is displayed. Also displayed are the payment terms for this invoice, and the related job and application for payment numbers, if applicable.

Cash Account

Displays the cash account to be used for posting this payment. The default cash account is set up in the System Wide Parameters, but can be changed on the CR Account tab. Since it is possible to have more than one cash account in the general ledger, make sure the correct account number is displayed.

Total

Displays the total amount of all line items entered. In order to save the record, this amount must match the payment amount entered above.