Effective January 1, 2023, the state of Colorado enacted the Colorado Family and Medical Leave Insurance program. functionality, effective January 1, 2023, has been added to BIS.

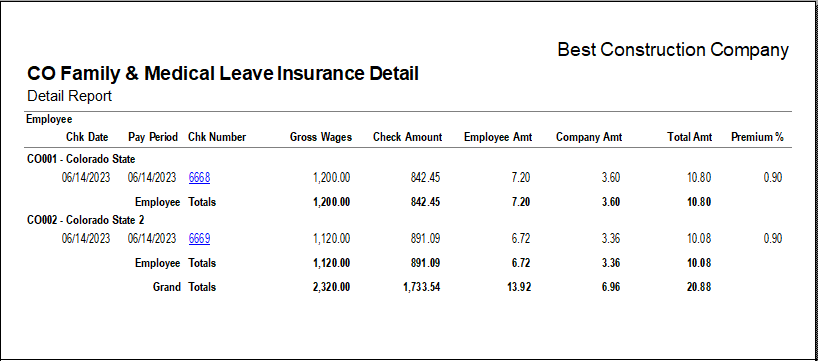

Colorado FAMLI is a shared fee between employers and employees based on 0.9% of wages. This rate is set through 2025 by Proposition 118, voted in by 57% of Coloradans as the authorizing vote of the people to create the FAMLI enterprise fund.

Employers are responsible for “remitting” on behalf of their employees or paying into the fund on their employees’ behalf. This is achieved through a wage deduction as a part of existing payroll processes. An employer is not required to pay more than 0.45% (or half the premium) into the program from its own business expenses.

If an employer has less than 10 employees, they are not required to pay the employer share.

If an employer has 10 or more employees, they may deduct up to 50% of the 0.9% premium as a standard payroll deduction.

Because the rate has already been set, this formula is used to calculate premiums as follows:

(Annual income X .009) / 2 = employer share

(Annual income x .009) / 2 = employee share

The upper limit of what an employer may be required to pay for a senior level or executive employee is capped at the same rate their social security withholding is. The Federal Social Security Wage Cap is set at $160,200 for earnings in 2023.

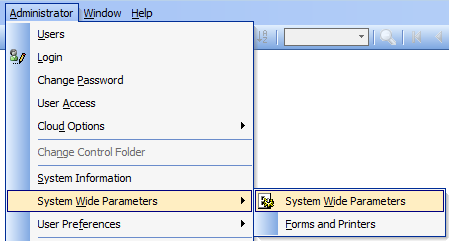

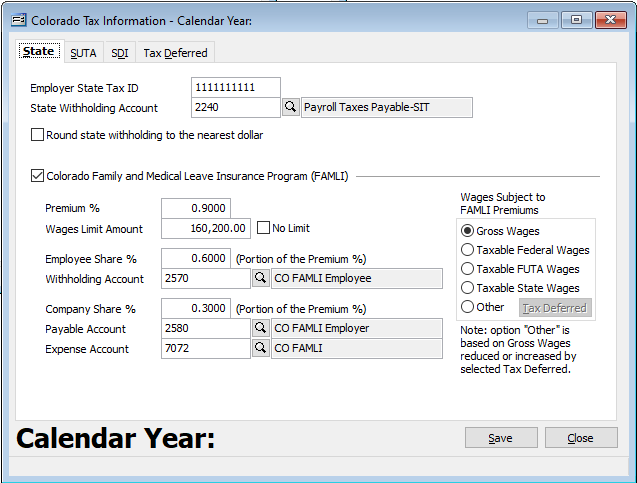

In BIS, the form for configuring the Colorado Paid Family & Medical Leave (FAMLI) is found in the State Tax Information for the state of Colorado, located in System Wide Parameters, PR tab, Taxes sub-tab, State Tax Information button.

On the Colorado Tax Information form check the “Colorado Family and Medical Leave Insurance Program (FAMLI)” checkbox and enter the Premium % and Wage Limit Amount along with the Employee Share % and corresponding account information, etc.

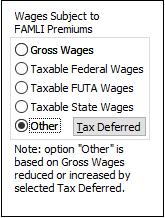

To the right select the “Wages Subject to FAMLI Premiums” that apply to your company.

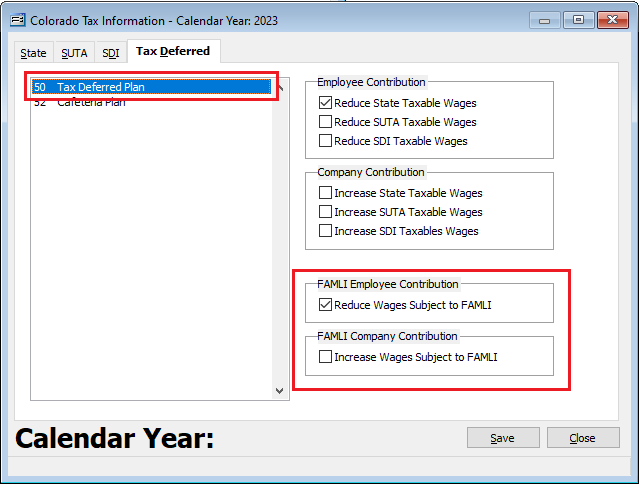

Note that selecting “Other” activates the Tax Deferred button to the right. Clicking Tax Deferred will redirect the user to the Tax Deferred tab where the existing tax deferred plans may be set accordingly in relationship to FAMLI program.

Once the desired settings are completed, click “Save.”

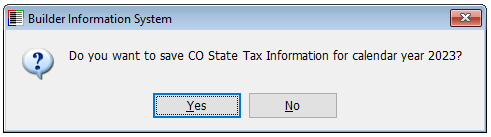

A prompt “Do you want to save CO State Tax Information for calendar year yyyy?”

Click “Yes.”

A second prompt “CO State payroll parameters were successfully saved.”

Close and save the System Wide Parameters.

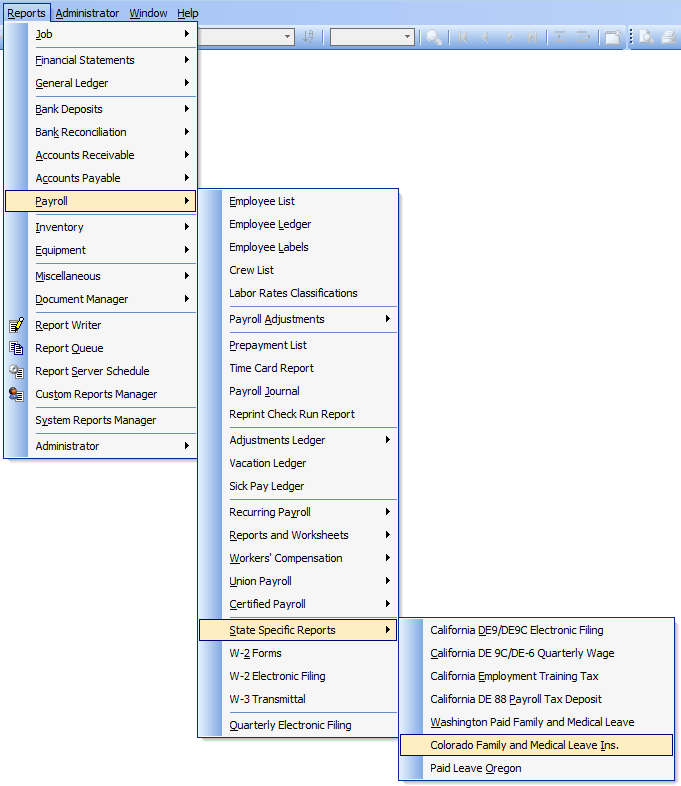

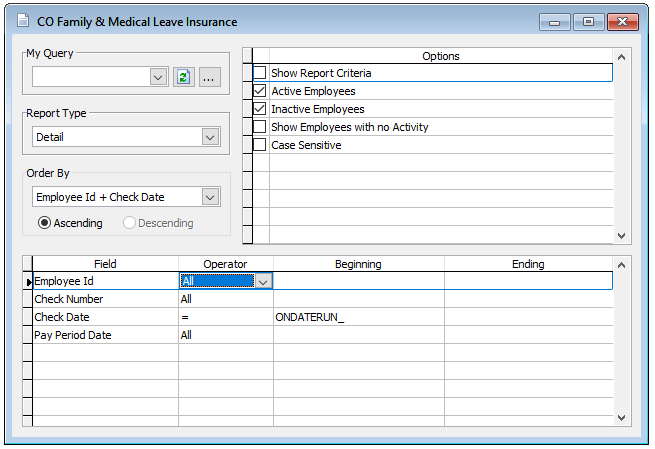

State Specific Report

A State Specific Report is available for Colorado in the Reports menu.