What Is the Connecticut Program?

The Connecticut Paid Family & Medical Leave (PFML) program was passed into law in June 2019. The program makes benefits available through a state-run program or employer plan. Benefits include:

Up to 12 weeks of Paid Leave for all covered employees.

Up to a maximum weekly benefit of 60 times the Connecticut minimum wage based on the following calculations:

- Covered employees will receive 95% of their base weekly earnings if they earn less than or equal to 40 times the state minimum wage.

- Covered employees earning more than 40 times the state minimum wage will receive 95% of 40 times the state minimum wage plus 60% on the portion of their base weekly earnings that is in excess of that amount up to the maximum weekly benefit.

Covered employees can use CT PFML benefits to:

- Welcome and bond with a new child (through birth, adoption or foster placement).

- Care for a seriously ill family member – or anyone related by blood or who is the equivalent of a family member.

- Tend to their own nonwork-related serious health condition.

- Donate an organ or bone marrow.

- Care for and/or support the needs of a family member in the military.

- Tend to personal needs as a victim of family violence.

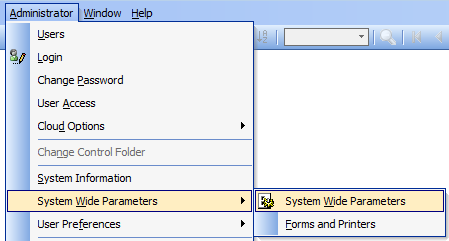

In BIS, the form for configuring the Connecticut Paid Family & Medical Leave (PFML) is found in the State Tax Information for the state of Connecticut, located in System Wide Parameters, PR tab, Taxes sub-tab, State Tax Information button.

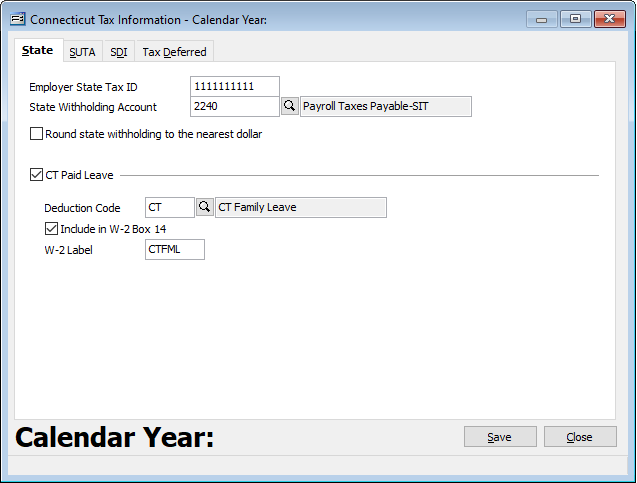

On the Connecticut Tax Information form check the “CT Paid Leave” Checkbox and enter the desired settings by selecting the Deduction Code used to withhold the Connecticut Paid Leave. Check the “Include in W-2 Box 14” checkbox and enter the desired W-2 Label to appear on the W-2

Once the desired settings are completed, click “Save.”

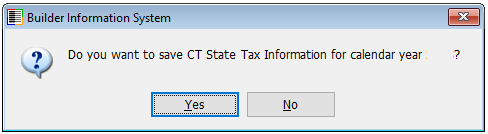

A prompt “Do you want to save CT State Tax Information for calendar year yyyy?”

Click “Yes.”

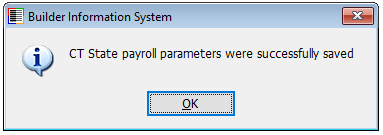

A second prompt “CT State payroll parameters were successfully saved.”

Close and save the System Wide Parameters.