Deduction codes are used to decrease an employee’s gross pay. Reasons for deductions include insurance payment, to pay back a payroll advance, or to withhold additional Federal or State taxes. For your convenience, BIS has 12 system deduction codes, which cannot be deleted. You may also create your own deduction codes to use.

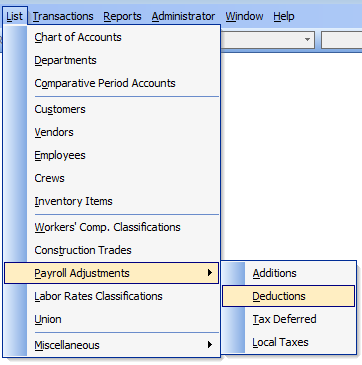

To add or modify information for a Deductions code, go to List, Payroll Adjustments and select Deductions in the menu or click the Additions link in the white area of the My Desktop Payroll module.

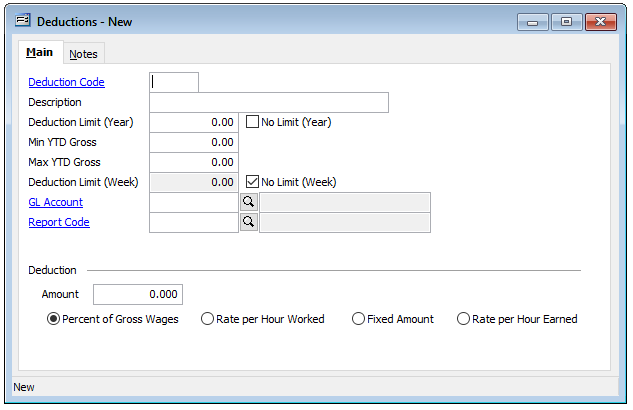

To create a new Deductions code, on the Main tab, enter a unique alpha-numeric code number and a Description Enter the annual limit for this deduction or check the No Limit box.

If there is a minimum year-to-date gross income required before this deduction can be made, enter that income in the Min YTD Gross field. Alternately, a maximum year-to-date gross income can be set, at which point the deduction will no longer be permitted. Alternatively, there is also a Deduction Limit (Weekly.)

Important note: If no limit amounts are entered, it is vital to check the No Limit check boxes to assure the deduction will function as needed.

Record a default general ledger account for posting this deduction and a report code, if you wish.

Enter the amount of the deduction and select how the deduction is to be applied: Percent of Gross Wages, Rate per hour Worked, Fixed Amount, or Rate per Hour Earned.

Optionally, the Note tab is available for recording any needed related notes.

Once all necessary information is entered or needed changes are made, save this record.