Addition codes are used to increase an employee’s gross pay for a variety reasons, including vacation or sick pay, non-payroll additions (such as a reimbursement), or an Advance Earned Income Credit payment. To assist you, BIS has 13 system addition codes that you may use. These system codes cannot be deleted. You may also create your own addition codes for situations not covered by the system codes.

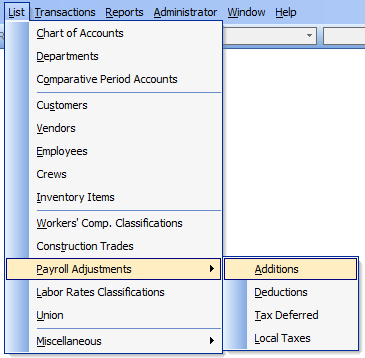

To add or modify information for an Additions code, go to List, Payroll Adjustments and select Additions in the menu or click the Additions link in the white area of the My Desktop Payroll module.

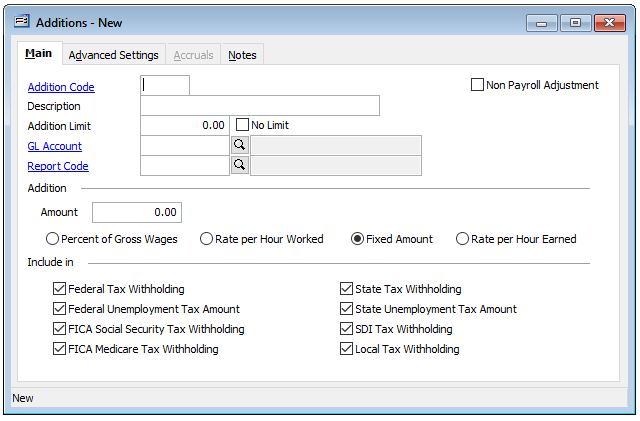

The form will open to create a new Additions code or use the Find, Lookup, or navigation buttons on the main tool bar to select an existing system code.

To create a new Additions code, on the Main tab, enter a unique alpha-numeric code number and a Description. Note the available checkbox option in the upper right to set it as a Non-Payroll Addition. If the addition is a non-payroll adjustment, this box should be checked so that BIS will not use any amount added by this code to calculate the employee’s payroll taxes. If not, use the check boxes provided at the bottom of the form to specify which Federal and State taxes should be applied to this income. NOTE: For security, some system codes do not allow you to change these settings.

Enter the annual limit for this addition, if one exists, or check the No Limit box.

If the addition is a fixed amount, you may enter it in the Addition Amount field. This amount may be overridden at the time payroll is entered. Many additions, such as vacation or sick pay, are given not as a fixed amount but on an hourly basis. In those cases, the amount should be left blank.

Enter a default general ledger account for posting this addition and a report code, if you wish.

Next, set the applicable process for how the addition is to be applied: Percent of Gross Wages, Rate per Hour Worked, Fixed Amount, or Rate per Hour Earned.

Finally, set the tax related checkbox settings according to the needs for the addition.

Optionally, on the Advanced Settings tab is the option to distribute to all Jobs / Cost codes. This requires a Job Cost “Other” GL account. As indicated, this will distribute the amount as “Other” cost to all the Jobs / Cost Codes equally. Note: that the system will not allow a Job Cost Labor GL account for the purpose.

Upon completing all necessary settings, save this record.

Note that the Accruals tab is greyed out for all Additions codes except code 10 – Vacation Pay and code 12 – Sick Pay, which allow for creating related Accruals programs. See “Vacation and Sick Leave Accrual” knowledge base article for details.

Once the Addition is completed and saved, it may be applied to the applicable employee master records for payroll.