Some users ask about the Credit Card Suspense account in the Chart of Accounts; they wonder why it never has a balance. Others ask what report will show them the credit card balance(s) at any given point in time. This FAQ is intended to answer both questions.

The fundamental principle applied to the Payment by Credit Card is that it does two things at once: It shows the original invoice as paid, and it creates a new invoice for the credit card company.

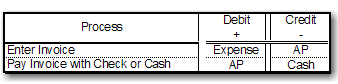

To explain this more fully, let’s look at a normal vendor invoice and payment T-Chart.

In this case, the new invoice is debited to an Expense, Cost of Goods Sold, or WIP account, and the Credit is to Accounts Payable. When the invoice is paid, Accounts Payable is debited and Cash Credited. Thus, the invoice is no longer a factor in Accounts Payable,

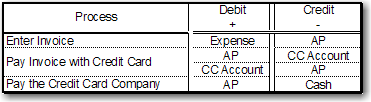

Now, let’s look at a Credit Card Process T-Chart.

The first step in the process is the same: The new invoice is debited to an Expense, Cost of Goods Sold, or WIP account, and the Credit is to Accounts Payable.

When the payment by credit card is entered, however, two different events occur:

- The original invoice is shown as paid, and the AP account is debited, but it is the Credit Card Suspense account that is credited.

- A new invoice is created for the credit card company as the vendor. Reversing Journal Entries are entered, a Debit to the Credit Card Suspense account and a Credit to the Accounts Payable account.

Finally, similar to the original cash/check transaction, the invoice is paid, but note that this invoice is for the credit card company and NOT for the original vendor. Thus, the Debit is to the Accounts Payable account and the Credit is to the Cash Account.

To review the amount owed to the credit card company, the user simply needs to run either a Vendor Aging Report for that credit card company as the vendor, or run a Vendor Ledger Report for the credit card company.

In fact, it may be very useful to create a saved Query in one or both of these reports for the needed credit card(s), as a preset vendor. This report may be used similar to a bank reconciliation process, enabling the user to simply check off the individual purchases listed against the monthly credit card statement.

The Payment by Credit Card feature offers users an easy way to enter and track the payments made to vendors by credit card.