Effective January 1, 2023, the state of Oregon instituted its Paid Leave Oregon program.

Note: Prior to setting the System Wide parameters settings for Paid Leave Oregon you may want to create both a Withholding account, a Payable account, and an Expense account for Paid Leave Oregon in the Chart of Accounts. (Go to List and select Chart of Accounts in the Menu to access.)

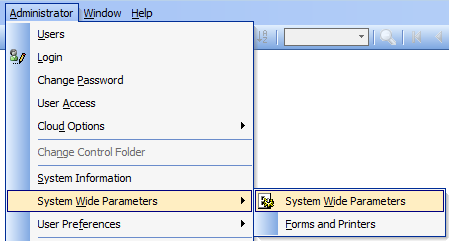

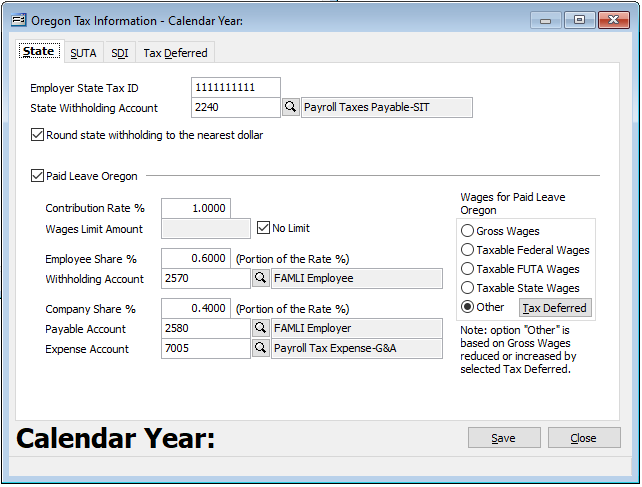

To setup Paid Leave Oregon in System Wide Parameters, go to Administrator, System Wide Parameters and select System Wide Parameters in the menu. Select the PR tab, Taxes sub-tab then click the State Tax Information button. Make sure there is a check-mark next to Oregon. Then click on the button under ‘Tax’. The screen below will appear; you will need to enter the information in the applicable fields.

On the Oregon Tax Information form check the “Paid Leave Oregon” checkbox and enter the Premium % and Wage Limit Amount along with the Employee Share % and corresponding account information, etc.

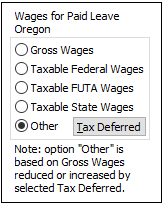

To the right select the “Wages for Paid Leave Oregon” that apply to your company.

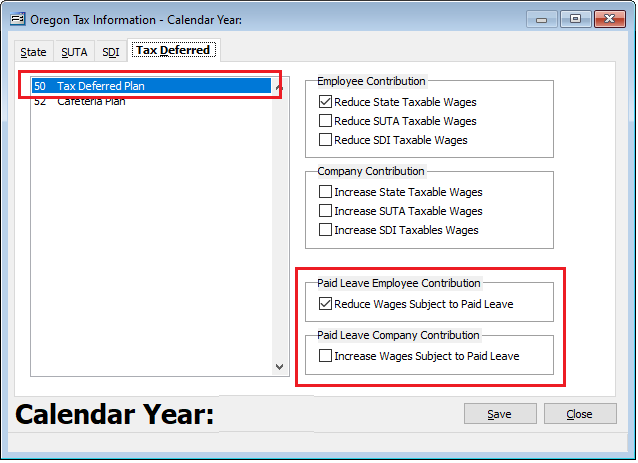

Note that selecting “Other” activates the Tax Deferred button to the right. Clicking Tax Deferred will redirect the user to the Tax Deferred tab where the existing tax deferred plans may be set accordingly in relationship to Paid Leave Oregon program.

Once the desired settings are completed, click “Save.”

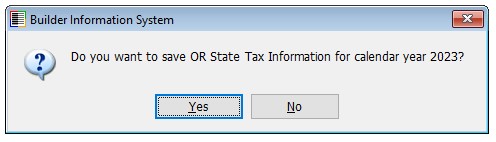

A prompt “Do you want to save OR State Tax Information for calendar year yyyy?”

Click “Yes.”

A second prompt “OR State payroll parameters were successfully saved.”

Close and save the System Wide Parameters.

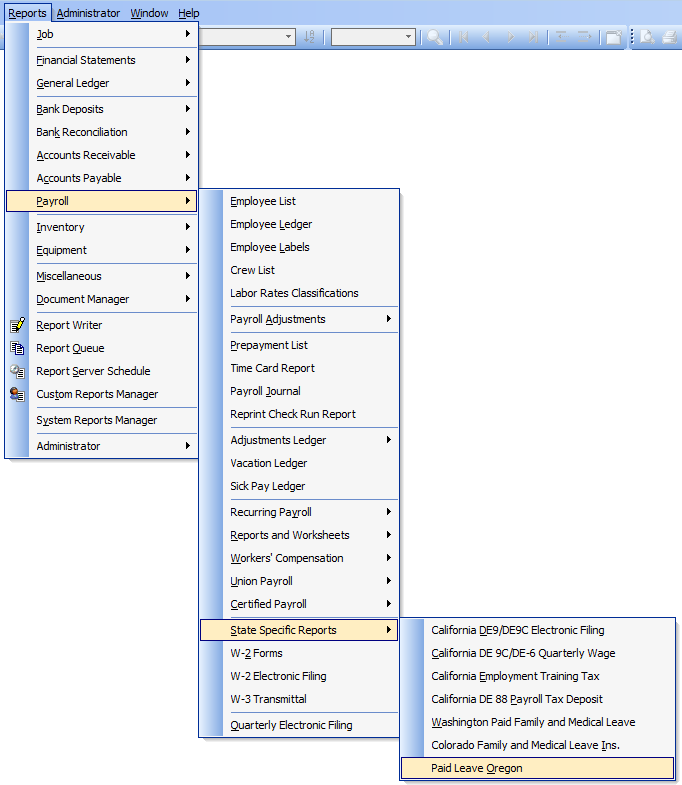

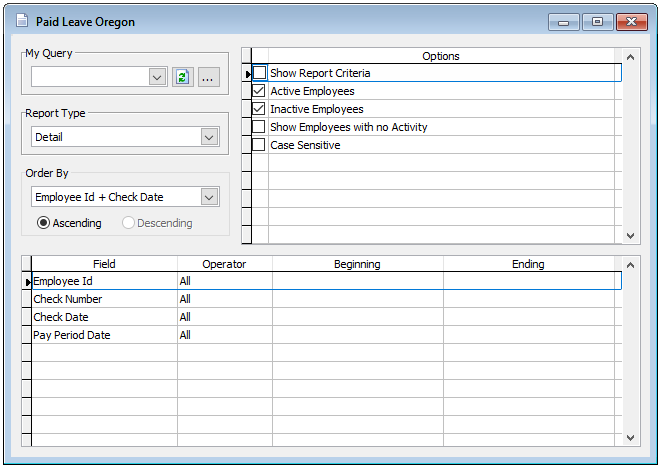

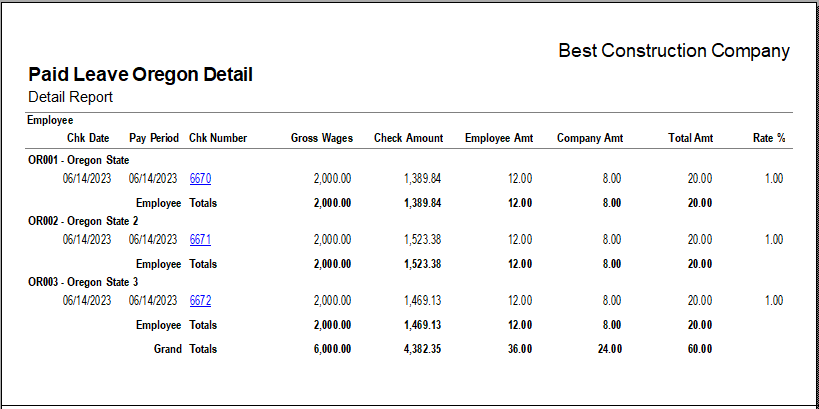

State Specific Report

A State Specific Report is available for Oregon in the Reports menu.