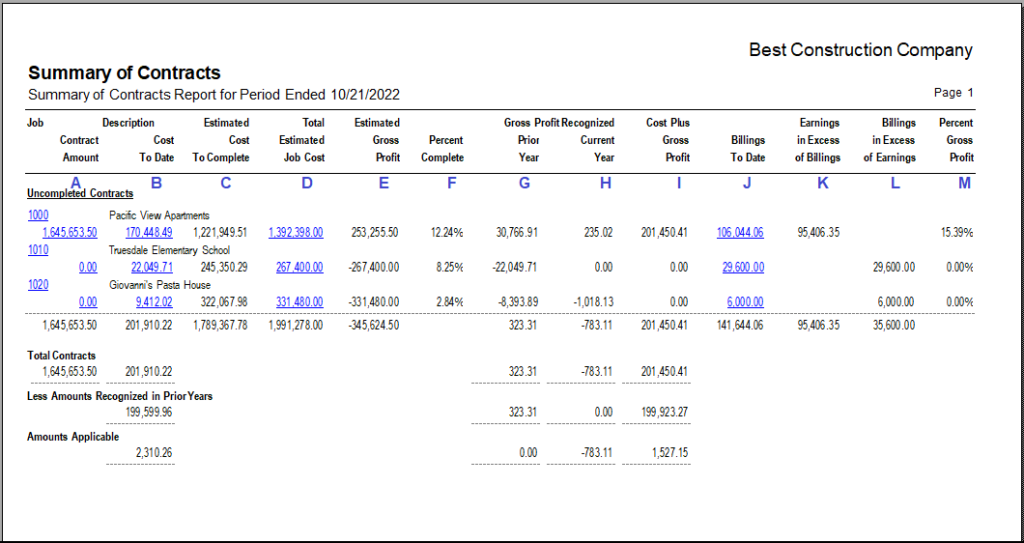

The Summary of Contracts Report is a date sensitive report that provides an overview of the job contract, billings and costs information with projected completion information including earnings and profits.

This report functions for jobs whether billed T & M, Unit Billing, or via Application for Payment or Contract Invoices. Depending on the type of billing method, the contract amounts, and related information may “pull” from different areas in BIS.

Please be aware that the Summary of Contracts report will “zero out” certain report fields when the Job’s master record status is set to Completed.

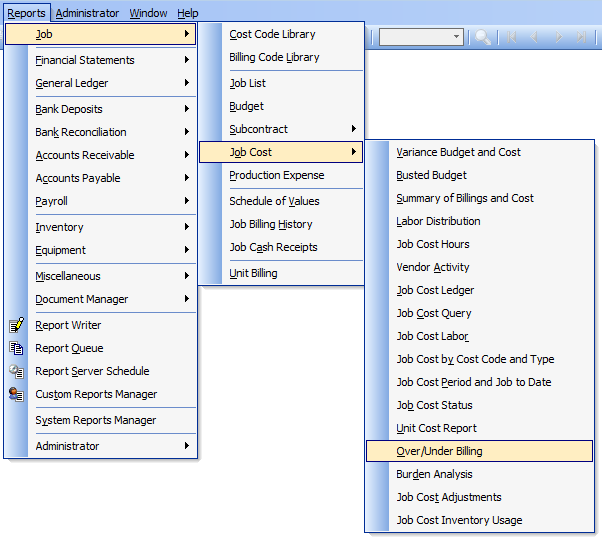

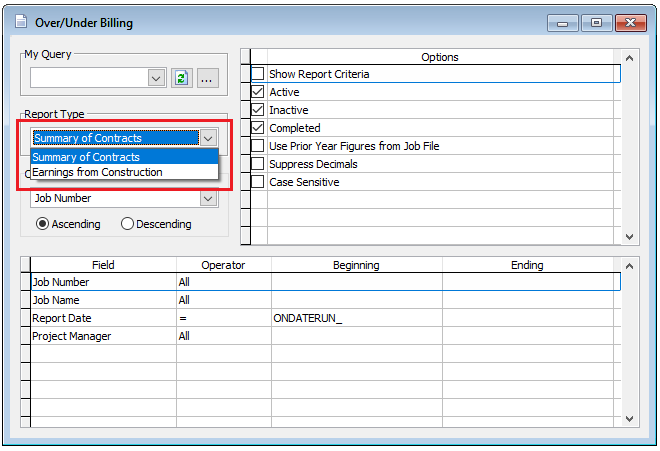

To access the report query form, go to Reports, Job, Job Cost and select Over/Under Billing in the menu or select the Over/Under Billing hyperlink in the blue area of the My Desktop Job Cost folder. Select Summary of Contracts from the Report Type dropdown list.

- Contract Amount:

For jobs billed via the Schedule of Values/Application for Payment process the Contract Amount comes from the Schedule of Values and are date sensitive.

For Time and Materials jobs, the contract amount is not date sensitive, the amount is the Cap (Contract) Amount entered on the T & M tab in the Job master record.

Unit Billing jobs are not date sensitive: Unit Billing Original Contract + Unit Billing Change Orders.

- Cost to Date: All accumulated costs to date.

- Estimated Cost to Complete: D – B

- Total Estimated Job Cost: Comes from the Job Budget Totals tab

- Estimated Gross Profit: (See schematic below.)

- Percent Complete: (Prior Year Cost + Cost to Date) / Total Estimated Job Cost) * 100

- Gross Profit Recognized Prior Year: (See schematic below.)

- Gross Profit Recognized Current Year: (See schematic below.)

- Cost Plus Gross Profit: (See schematic below.)

- Billings to Date: (See schematic below.)

- Earnings in Excess of Billings: (See schematic below.)

- Billings in Excess of Earnings: (See schematic below.)

- Percent Gross Profit: (See schematic below.)

Over/Under Billing – Summary of Contracts Report Schematic:

- Contract Amount

- For Completed and Uncompleted Contracts

- For Time and Material Job – (Not Date Sensitive)

- Cap (Contract) Amount (Form the Jobs master file, T&M tab)

- For Unit Billing Job – (Not Date Sensitive)

- Unit Billing Original Contract + Unit Billing Change Orders

- For other Jobs – (Report Date Sensitive)

- S of V Original Contract + S of V Change Orders

- For Time and Material Job – (Not Date Sensitive)

- For Completed and Uncompleted Contracts

- Cost to Date – (Report Date Sensitive)

- For Completed and Uncompleted Contracts

- Total job cost to date

- For Completed and Uncompleted Contracts

- Estimated Cost to Complete

- For Completed Contracts

- Zero

- For Uncompleted Contracts

- Total Estimated Job Cost – Cost to Date

- For Completed Contracts

- Total Estimated Job Cost – (Not Date Sensitive)

- Total job cost for the Job

- Estimated Gross Profit

- For Completed Contracts

- Zero

- For Uncompleted Contracts

- Contract Amount – Total Estimated Job Cost

- For Completed Contracts

- Percent Completed

- If Total Estimated Job Cost is equal to zero

- Zero

- If Total Estimated Job Cost is different than zero

- (Cost to Date / Total Estimated Job Cost) * 100

- If Total Estimated Job Cost is equal to zero

- Gross Profit Recognized

- Prior Year

- Use Prior Year Figures from Job File

- If Prior Year Ending Date (From Jobs master file, History tab) equals Prior Fiscal Year Ending Date

- Gross Profit Recognized (From Jobs master file, History tab)

- Else

- Zero

- If Prior Year Ending Date (From Jobs master file, History tab) equals Prior Fiscal Year Ending Date

- Not use Prior Year figures

- If Total Estimated Job Cost different than zero

- (Contract Amount – Total Estimated Job Cost) * (Total cost prior year / Total Estimated Job Cost)

- Else

- Zero

- If Total Estimated Job Cost different than zero

- Use Prior Year Figures from Job File

- Current Year

- For Completed Contracts

- Contract Amount – Cost to Date – Gross Profit Recognized Prior Year

- For Uncompleted Contracts

- If Total Estimated Job Cost is different than zero

- ((Cost to Date / Total Estimated Job Cost) * (Contract Amount – Total Estimated Job Cost) / 100) – Gross Profit Recognized Prior Year

- Else

- Zero – Gross Profit Recognized Prior Year

- If Total Estimated Job Cost is different than zero

- For Completed Contracts

- Prior Year

- Cost Plus Gross Profit

- Cost to Date + Gross Profit Recognized Current Year + Gross Profit Recognized Prior Year

- Billings to Date – (Report Date Sensitive)

- AR (Invoice Amount – Tax Amount)

- Earnings in Excess of Billings

- For Completed Contracts

- Zero

- For Uncompleted Contracts

- If (Cost Plus Gross Profit – Billings to Date) is equal or greater than zero

- Cost Plus Gross Profit – Billings to Date

- Else

- Zero

- If (Cost Plus Gross Profit – Billings to Date) is equal or greater than zero

- For Completed Contracts

- Billings in Excess of Earnings

- For Completed Contracts

- Zero

- For Uncompleted Contracts

- If (Cost Plus Gross Profit – Billings to Date) is minor than zero

- Cost Plus Gross Profit – Billings to Date

- Else

- Zero

- If (Cost Plus Gross Profit – Billings to Date) is minor than zero

- For Completed Contracts

- Percent Gross Profit

- If Cost Plus Gross Profit is greater than zero

- ((Gross Profit Recognized Current Year + Gross Profit Recognized Prior Year) / Cost Plus Gross Profit) * 100

- Else

- Zero

- If Cost Plus Gross Profit is greater than zero

Question: How do you get the Gross Profit recognized from the Prior Year?

Answer: In Job Cost/Over Under Billing report you must place a check mark in the Option box. Also, you must have entered the amounts for the Prior Year in the Job Master Record/History tab.