This form allows you to manage tax deferred compensation and cafeteria plans for your employees through this option. BIS maintains the following payroll adjustments master record: Additions, Deductions, Tax Deferred and Local Taxes. These adjustments must exist in the master file prior to setting up adjustment defaults in an employee master record or being used in the Payroll Hours and Adjustments entry.

It is imperative that you contact your accountant before entering the taxation parameters for these plans. If the taxation is not correct, all of your payroll information will be incorrect. The Main tab is used to set the basic information for each adjustment, while detailed default information for employees and contributions are set up on the corresponding tabs.

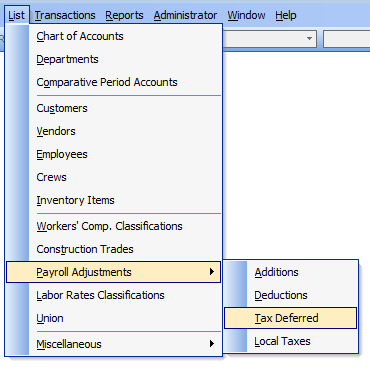

To add or modify information for a Tax Deferred code, go to List, Payroll Adjustments and select Tax Deferred in the menu or click the Tax Deferred link in the white area of the My Desktop Payroll module.

There are a number of system tax deferred compensation codes that are already set up in BIS:

- 401(k)

- Cafeteria Plan

- Cafeteria Plan

These codes cannot be changed or deleted. However, new codes can be added at any time to cover an adjustment not included above. Setting up all default information in the Tax Deferred file will save time when entering payroll records. The information saved here will appear as the default when a tax deferred adjustment is made in Payroll Hours and Adjustments, although the defaults may be changed at the time of payroll entry, if necessary. Use the Find feature to lookup and select from the existing codes.

NOTE: The defaults set here will also appear on the Tax Deferred tab of the employee master record. If selected as an automatic adjustment, the defaults may be changed, creating new defaults that will override the basic contribution settings for that employee’s automatic company or employee contribution only.

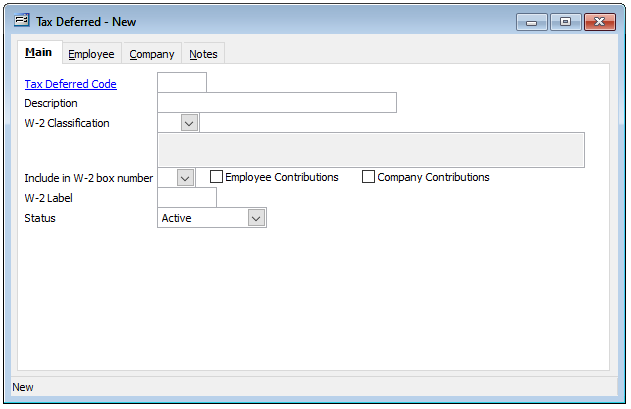

To create a new Tax Deferred record, on the Main tab enter a new code (alpha-numeric up to 5 integers) and description. Select a W-2 Classification. Next select a W-2 box number, if applicable. Next, check the Employee Contributions and Company Contributions checkboxes that apply. An optional W-2 Label (alpha-numeric up to 5 integers) may be entered.

Field Descriptions:

Tax Deferred Code

Records a unique code that will correspond to this tax deferred adjustment. This code may be any combination of letters and/or numbers, up to five characters.

Description

Records a description of the tax deferred adjustment, up to 30 characters.

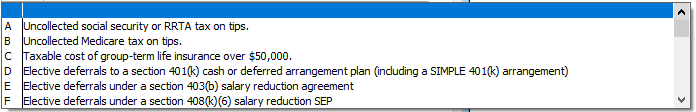

W-2 Classification

Specifies the W-2 classification for this tax deferred adjustment. Use the drop-down menu to select the correct classification.

W-2 Category

Specifies the W-2 category for this tax deferred adjustment. Use the drop-down menu to select Tax Deferred or Cafeteria Plan.

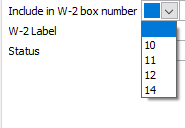

Include in W-2 box number:

W-2 Label allows a label to appear adjacent to the selected W-2 box number.

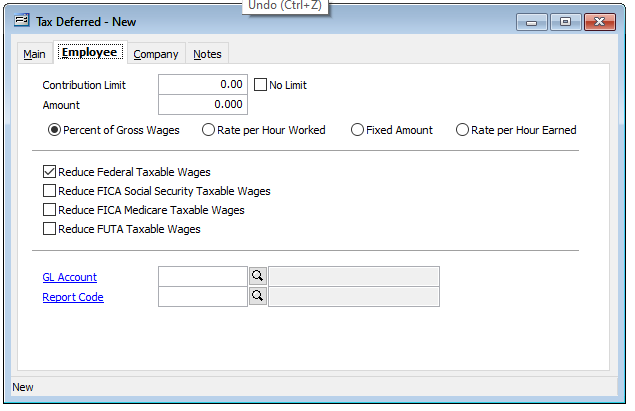

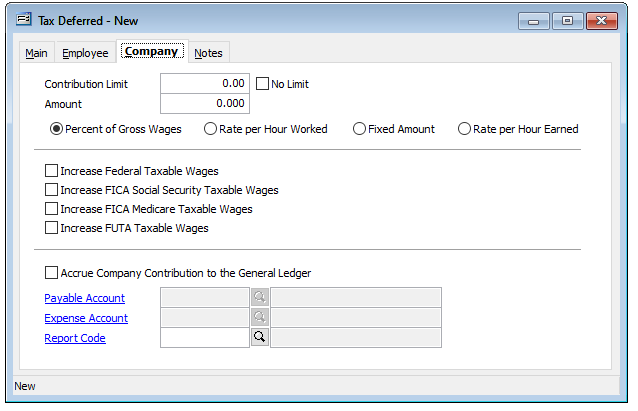

Next, enter all the information on the Employee and/or Company tabs as it applies to the Tax Deferred master record.

Note: Check the “No Limit” check-boxes if no Contribution Limits are entered. Save the record.

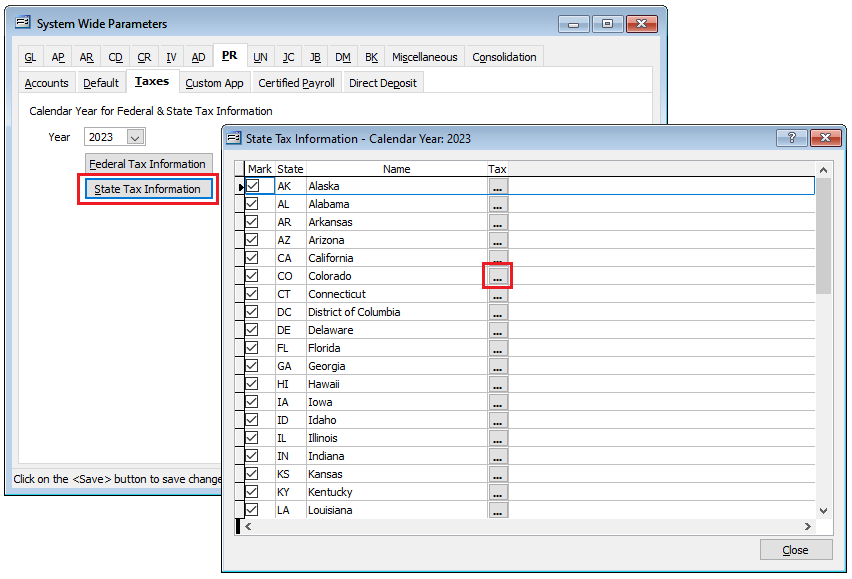

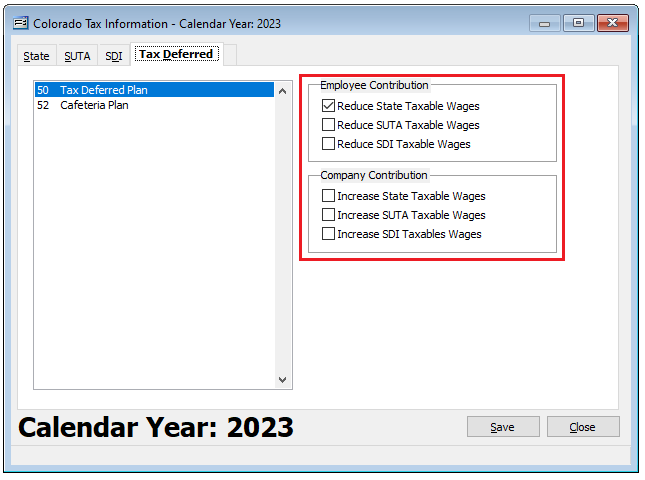

IMPORTANT: Once the Tax Deferred plan is initially entered and saved. The state portion of the plan must be completed in System Wide Parameters, PR tab, Taxes sub-tab, select the tax Year and click the State Tax Information button. Click the Tax ellipsis button adjacent to the applicable state. On the State Tax Information form.

On the State Tax Information form, select the Tax Deferred code in the left window and set the tax settings as they apply for the state to the Tax Deferred code. Save the settings and close the form.

Once the Tax Deferred plan is created as needed, the Employee master records may be set up accordingly. (See Setting Up an Employee Tax Deferred.)