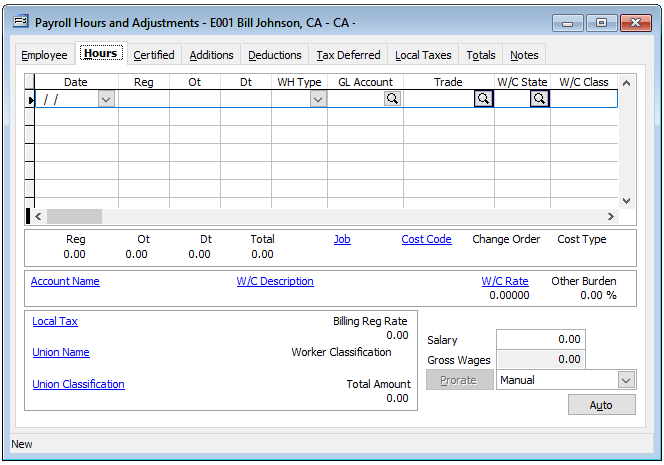

Payroll Hours and Adjustments – The Payroll Hours and Adjustments form is used to enter current payroll activity for each employee in preparation for processing payroll. The file will only maintain payroll records for a single pay period at a time; the period ending date must be the same for all saved records at any given time. The Employee tab is used to maintain basic information for each payroll record.

Once all payroll records have been correctly entered, payroll checks can be run using the Print Payroll Checks options. Your books are updated once the payroll checks are printed. However, when payroll information is entered in the Payroll Hours and Adjustments file, the related labor job costs are committed prior to running checks.

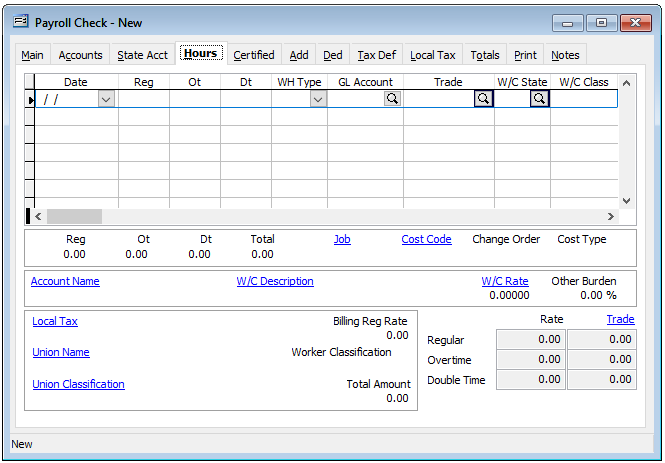

Cash Disbursements Payroll Check Form – The Payroll Manual Checks option allows you to record a manually written payroll check. Alternatively, it can be used to print on-the-spot checks you do not wish to process on an accrual basis. This form is also used to enter the payroll beginning balances when you are setting up your existing employees for the first time in BIS. Single paychecks can also be printed or reprinted from here using the Print button on the main tool bar. All checks run using the Print Payroll Checks option will appear in this file once posted. The Main tab records basic information related to the check written.

Unlike the Payroll Hours and Adjustments form, the Payroll Manual Checks form does not automatically calculate Federal and State taxes. These amounts should be calculated and entered manually on the Totals tab. However, the fields and tabs on this form function in a similar manner to those on Payroll Hours and Adjustments.

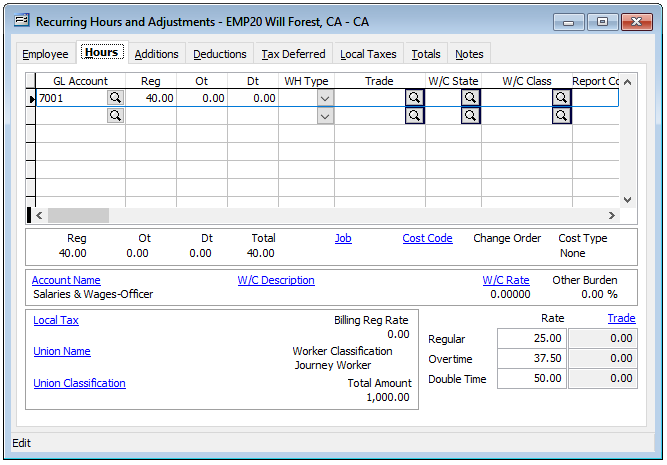

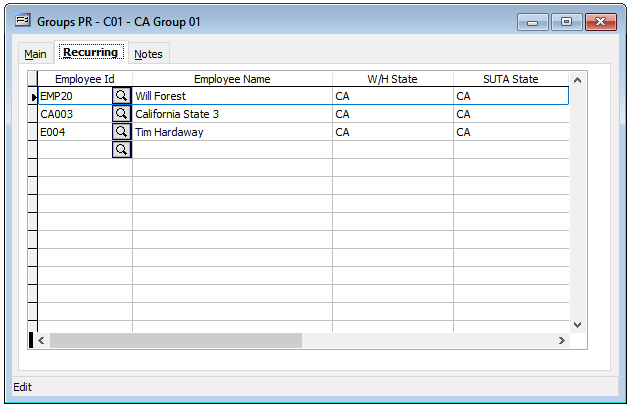

Recurring Payroll – Certain payroll transactions may be repeated on a regular basis, usually involving salaried employees, or hourly employees whose hours rarely vary. To save time and minimize errors in making these payroll entries, recurring payroll transactions can be created that simply require loading at regular intervals.

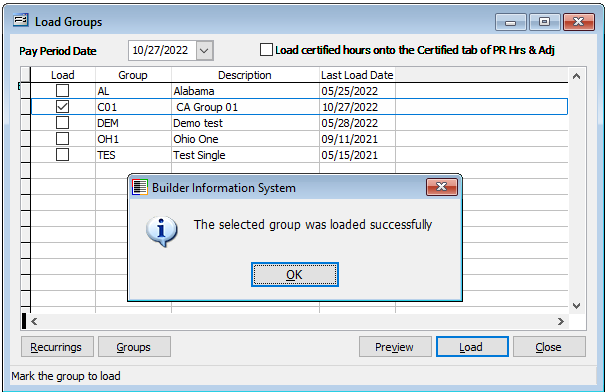

This section covers the four elements of recurring payroll setup and use: Recurring PR, Groups, Load Groups, and Unload Groups. The first two of these elements are needed to set up a recurring payroll. The last two are needed to process recurring payroll.

Once a recurring payroll has been loaded, all of its elements are available in Payroll Hours and Adjustments, either to be applied “as is,” or to be modified as needed.

Three steps are required in completing recurring transactions:

Setting up the transaction forms.

Grouping the transaction forms for loading.

Loading the transactions.

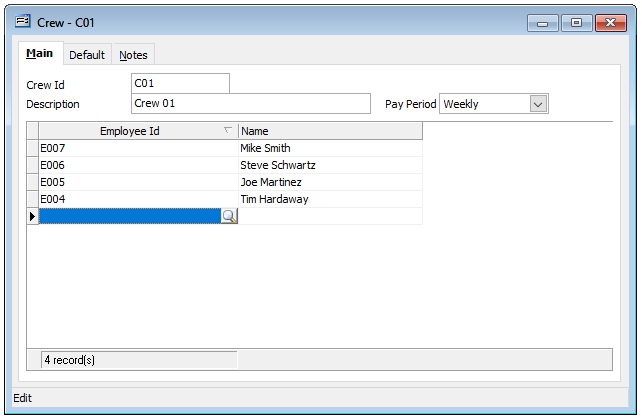

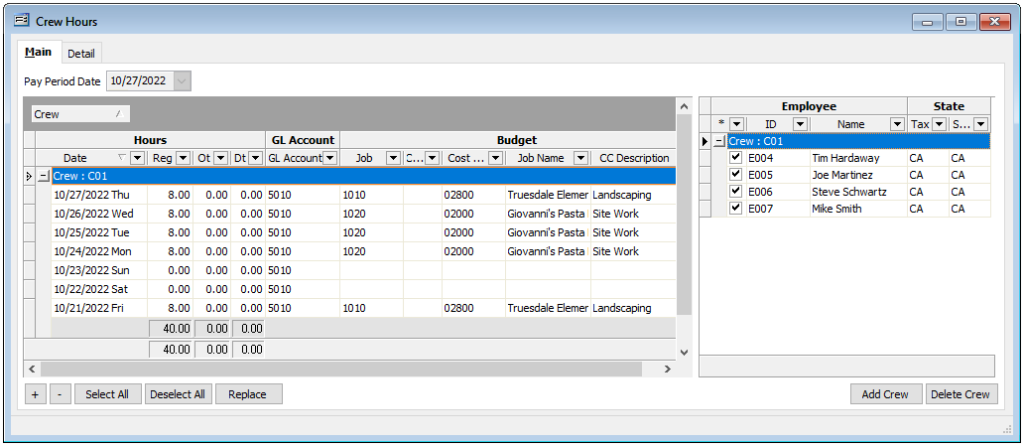

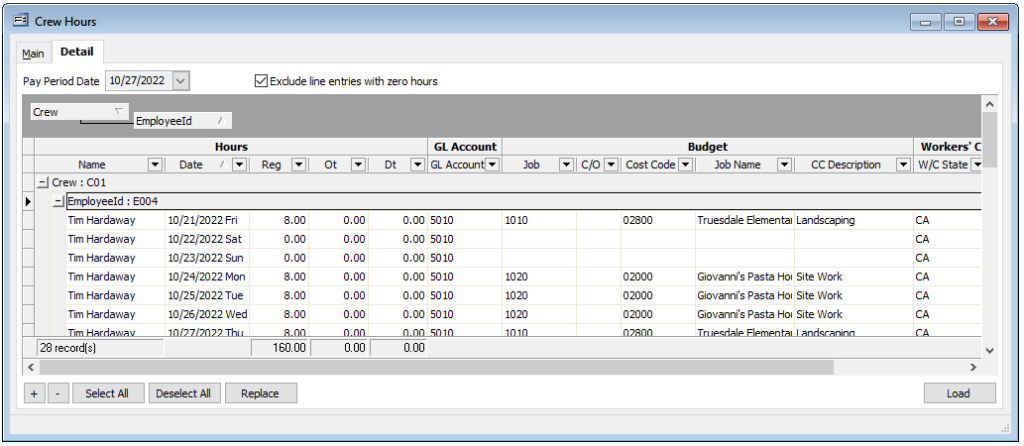

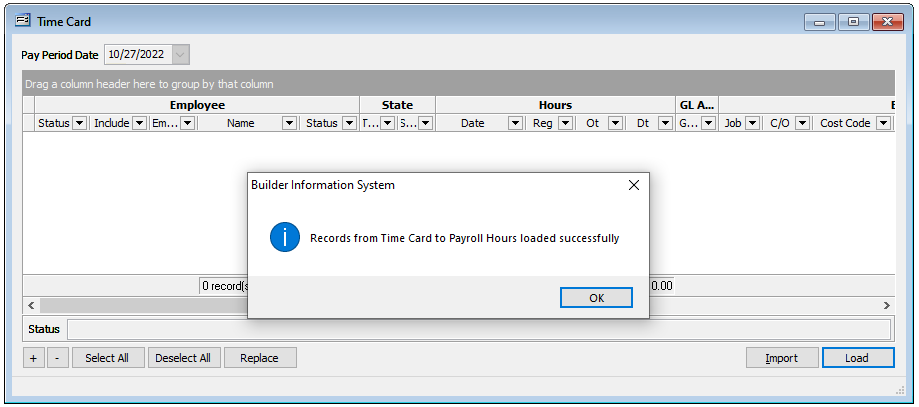

Crew Hours – Crews and Crew Hours is an optional Payroll feature that allows employee crews to be created, crew hours quickly distributed and then easily loaded into Payroll Hours and Adjustments to complete the payroll process. The Crew Hours process may be utilized in tandem with other payroll entry processes: Recurring Payroll,

Timecard, and manually entered payroll.

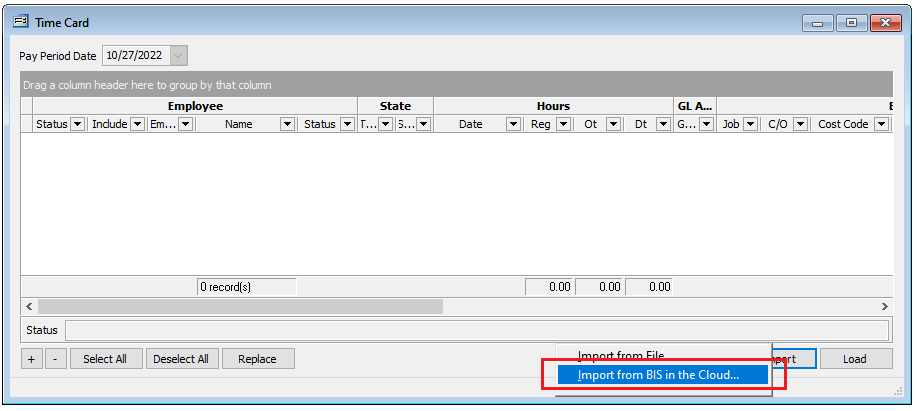

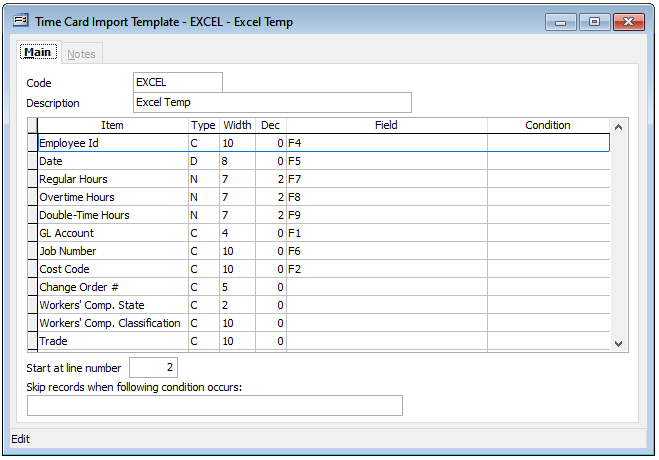

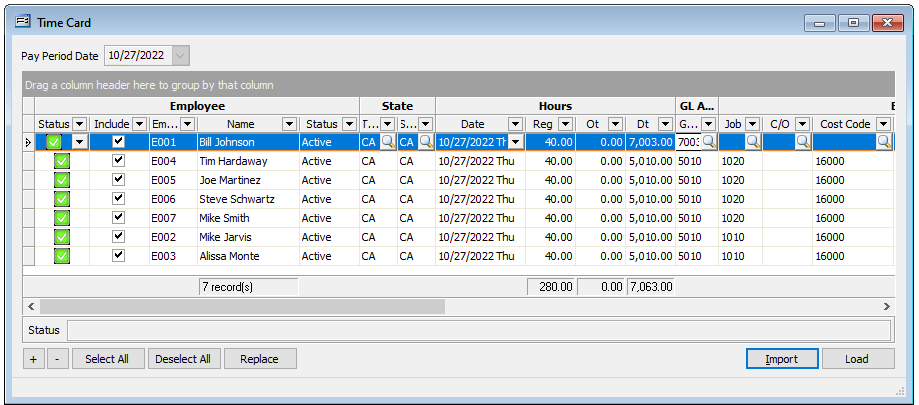

Timecard Import – Time Card Import provides the option to import payroll information from a .CSV file generated by About Time® timecard software, from a spreadsheet, or from BIS In the Cloud. The CSV (Comma Separated Value) should include the Employee Code, Job Code, Cost Code, Hours Type (Regular/Overtime/Double time), Date, Hours, and Trade Classification (optional if utilized).

Cloud Timecard – Is an optional provided server timecard service in the Cloud. It utilized the same Timecard Import form and a BIS default “Import from the Cloud” template.