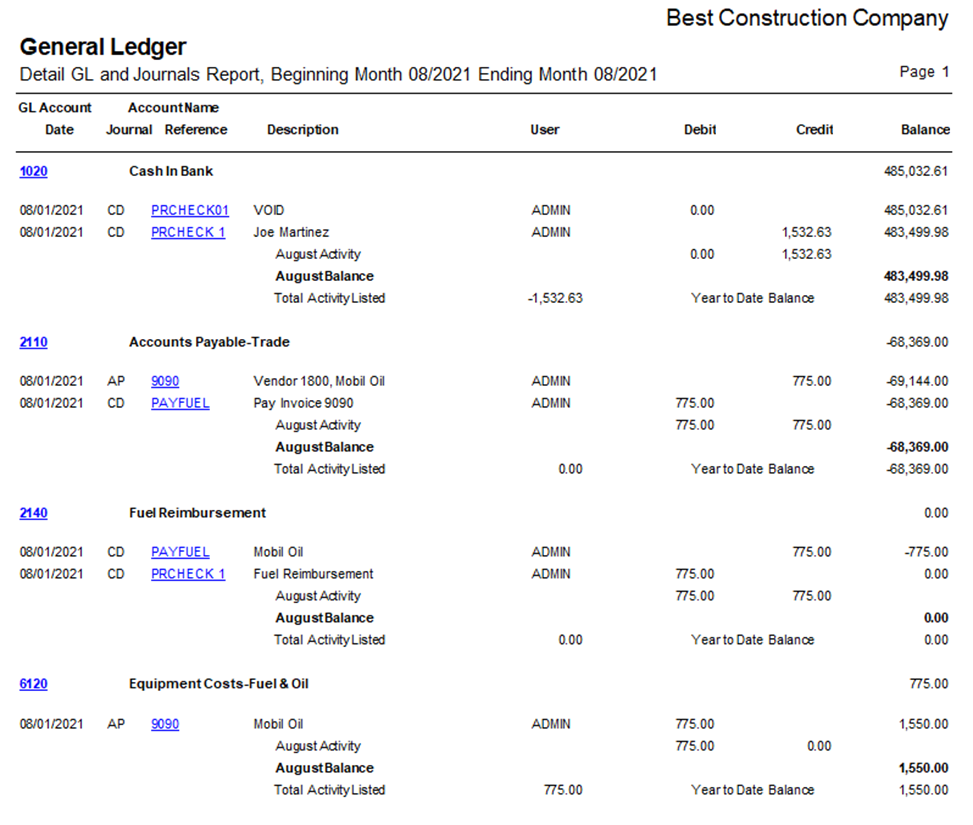

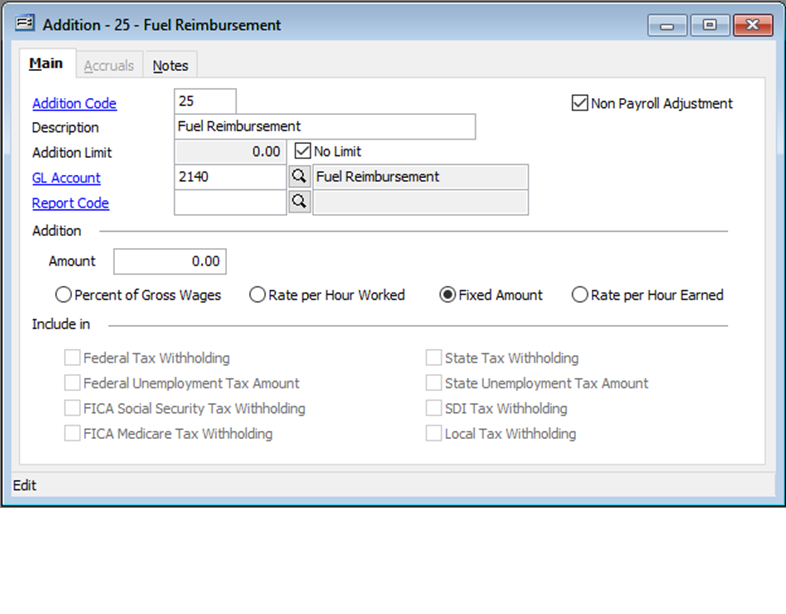

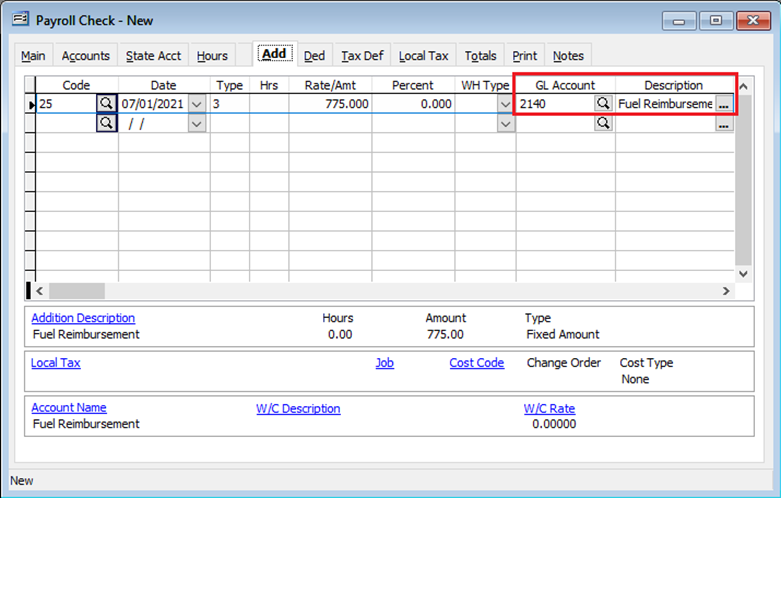

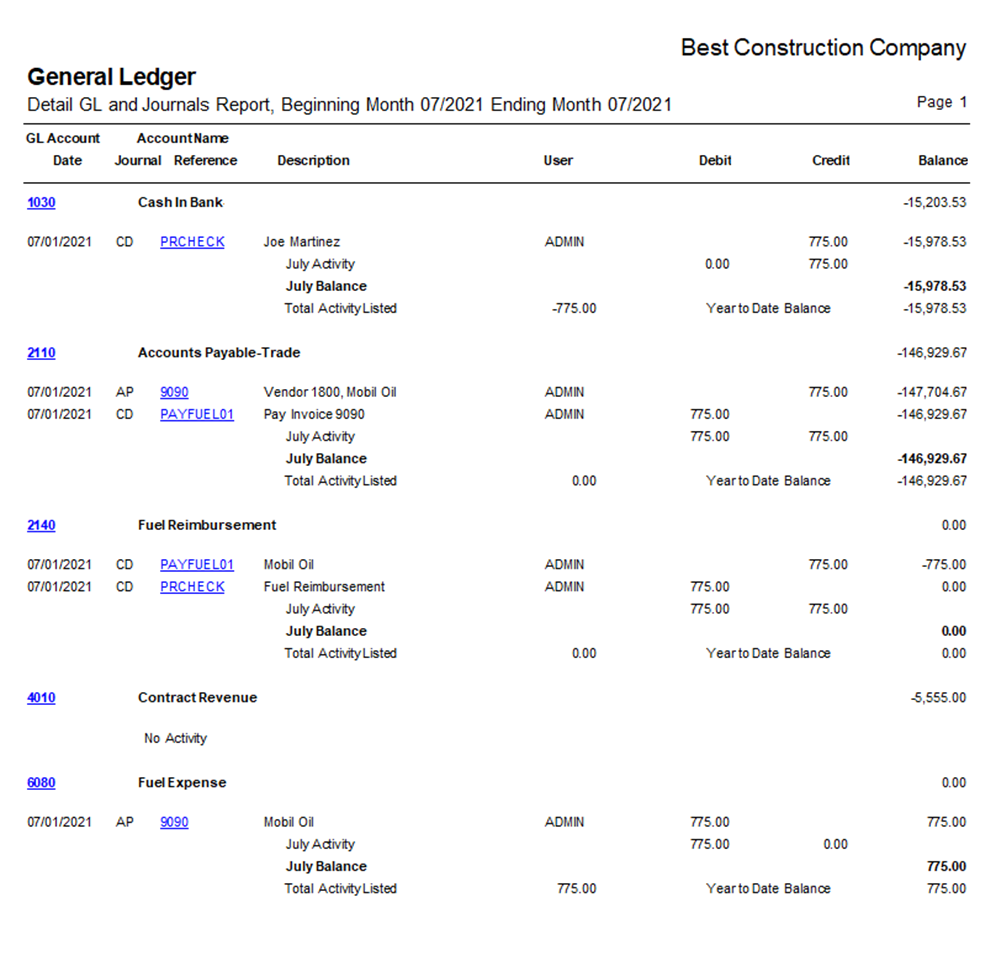

In Payroll Hours & Adjustments the Employee is reimbursed for fuel in the amount of $775.00 using a newly created “non-payroll” Fuel Reimbursement Addition Account 2140 – Fuel Reimbursement.

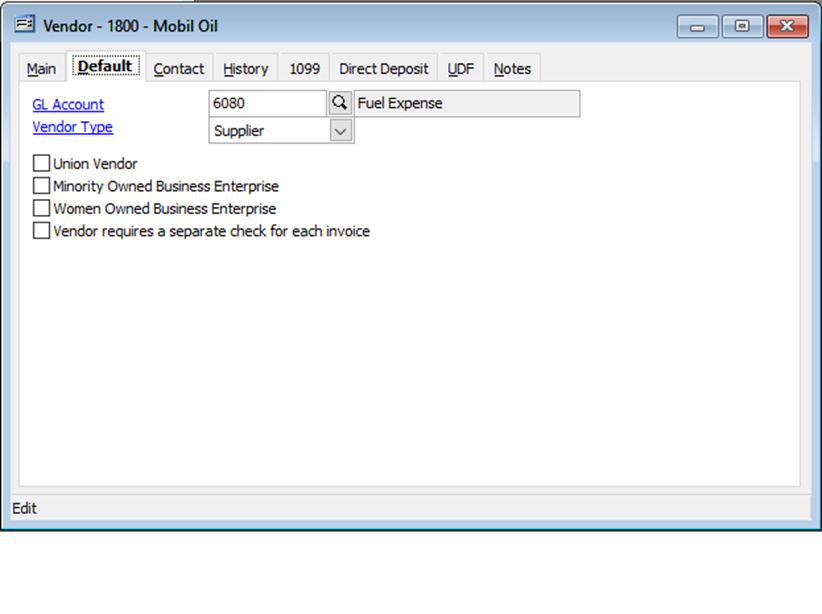

The Fuel provider is Vendor 1800 – Mobil Oil:

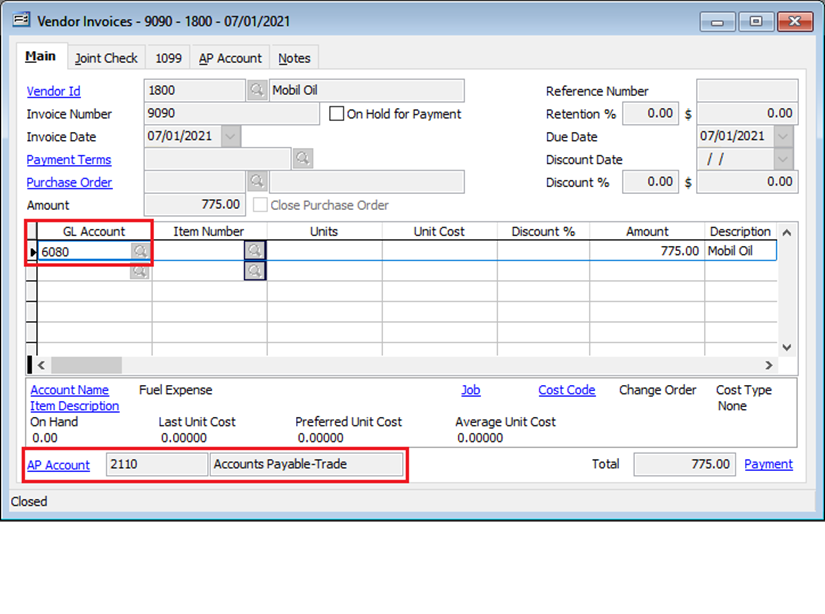

Create a Vendor Invoice to the fuel provider (1800 – Mobil Oil) with a newly created GL account 6080 – Fuel Expense account and the normal AP Account.

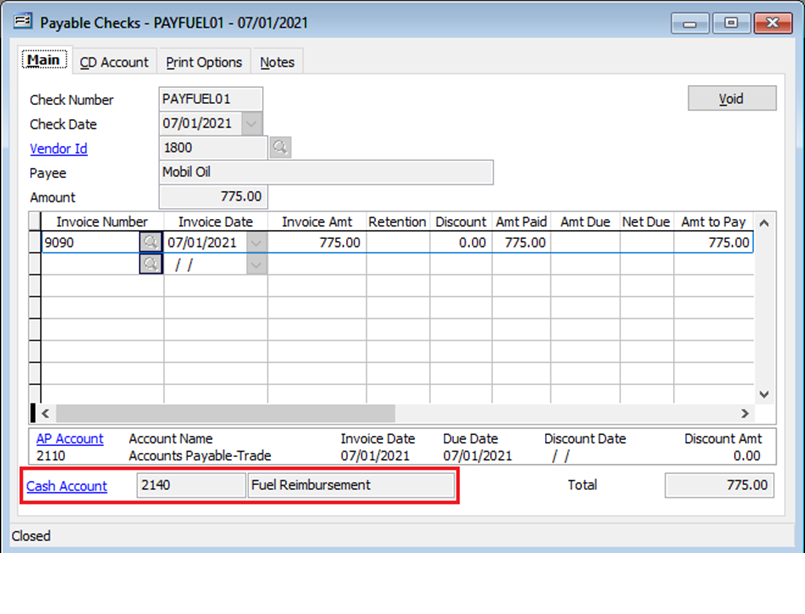

Then pay the Vendor Invoice using CD Payable Check Form with the Cash Account set to the account 2140 – Fuel Reimburse.

The Fuel Expense hits the Fuel Expense Account 6080.

The caveat with this method is that the Vendor Invoices will not show up on AP Aging reports using the normal AP account.