Once a tax deferred plan is set up and available, the plan may be tailored to individual employee needs, in the employee’s master record.

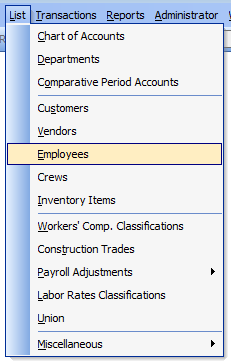

To add or modify a Tax Deferred code to an employee master record, go to List, and Employees in the menu or click the Employees link in the white area of the My Desktop Payroll module.

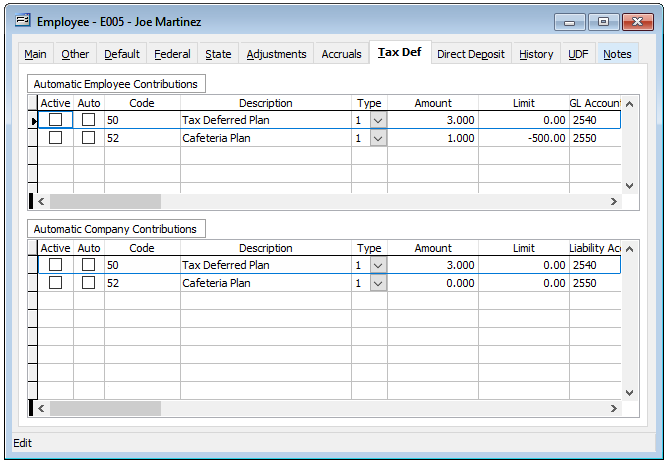

On the Employees form, use the Lookup or Navigation buttons to find and select the desired employee master record. Once selected, click on to the “Tax Def” tab.

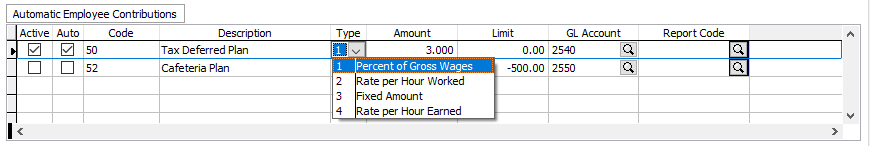

To set the Employee portion of a tax deferred plan, first check the “Active” checkbox adjacent to the plan code. Optional, the plan may be set as “Automatic” if it is to be applied automatically for each pay period. Next, select the Type from the drop-down list. Enter the Amount and a Limit if it applies. A GL Account is required if one has not been set in the Tax Deferred master record. Optionally, a Record code may be utilized.

The upper portion is the Employee Contributions relationship while the lower portion is the Company Contributions. Once the employee’s tax deferred relationship is set, Save the settings.

Once all employees are set, the process may be verified by entering the employees in PR Hours and Adjustments and viewing the information either on the Totals tab or on the PR Prepayment report.