Create, accrue and track vacation and sick leave plans.

The Payroll Adjustments Addition codes 10 (Vacation Pay) and 12 (Sick Leave) have a tab for defining accrual plans. These plans can be assigned to employees on the employee master record, show accruals on the check Totals tab and check stubs, and have reports. Accrual plans can be based on a Pay Period or Rate Per Hour method.

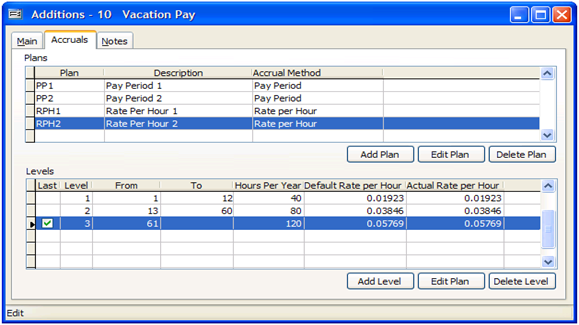

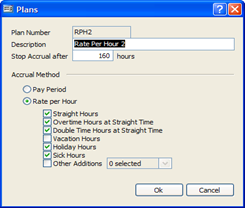

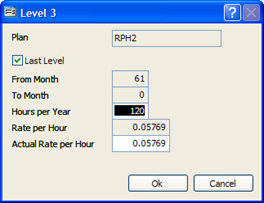

Figure 1 below shows an example of 4 Vacation Plans based on Pay Period and Rate Per Hour; Figures 2 & 3 shows examples of the setup screens for the Plans and Levels.

Figure 1:

Figure 2:

Figure 3:

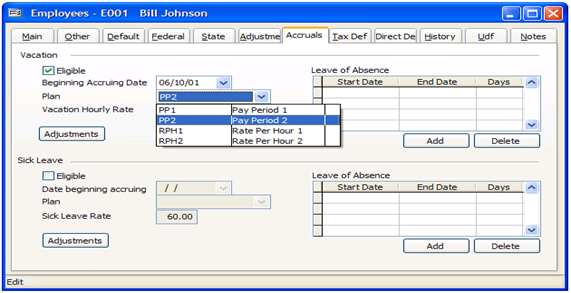

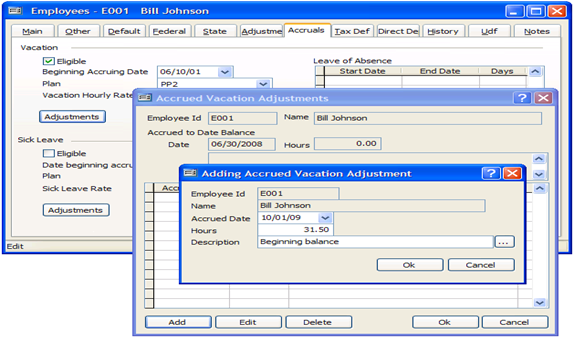

Setting up the employee master record and beginning balance is shown below in Figures 4 and 5. The “Eligible” setting must be selected in order for the plan to accrue. If needed, a setting has been added to the System Wide Parameters PR tab to “Allow to use more vacation hours than accrued.” Beginning balances and other adjustments can be entered through the Adjustments button. When a Leave of Absence condition is created the accrual will be on hold during the dates specified.

Figure 4:

Figure 5:

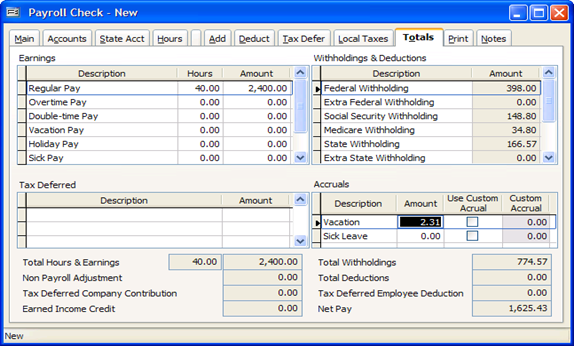

The Totals tab on Payroll Hours & Adjustments and Cash Disbursements | Payroll Checks will show the current amount being added for that check. On-the-fly adjustments can be created by selecting the “Use Custom Accrual” setting which opens the Custom Accrual field.

Figure 6:

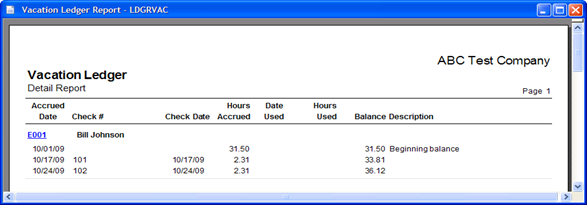

A new Vacation Ledger report has been added with Summary and Detail formats to track accruals and usage. Other reports such as Prepayment List, Preview within Print Payroll Checks, Payroll Check Run, and Payroll Summary will also show accrual amounts.

Figure 7:

All examples shown above for Vacation Accrual also apply for Sick Leave Accrual.